Executive Summary 🔗

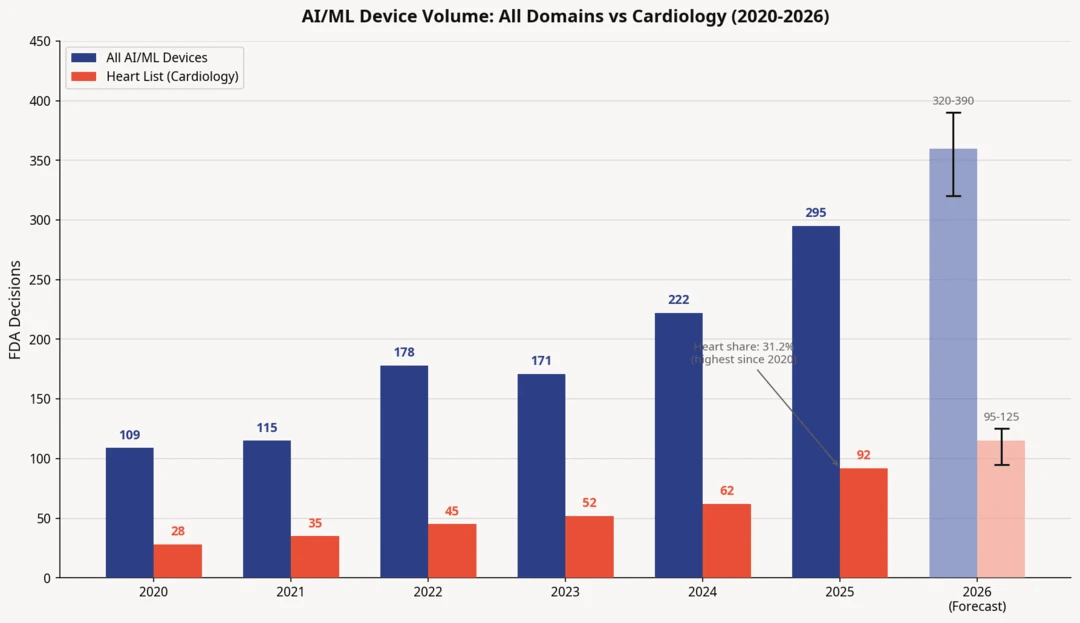

- 92 AI/ML-related FDA clearances in 2025, with image-processing and workflow software product codes dominating.

- Coronary CT was a major category: 9 plaque-related tools, 7 CAC-related tools, and 3 FFR/FFRct/QFR-related tools were cleared.

- Hospital outpatient payment for CCTA increased in 2025 (per ACC reporting). New 2026 CPT updates include Category I codes tied to CT-derived FFR and CT perfusion.

- 8 of 92 2025 clearances were PCCP-authorized, spanning imaging software, cardiology analytics, and consumer device features.

- Multiple companies announced financing rounds or IPO filings around the time of their 510(k) clearances (see case studies below).

2025 Cardiology AI/ML Clearances at a Glance 🔗

| Metric | Value |

|---|---|

| Total 2025 AI/ML cardiology clearances | 92 |

| Unique applicants | 69 |

| Unique manufacturers deduplicated | 63 |

| SaMD | 59 |

| Non-SaMD | 33 |

| Panel: Radiology | 69 |

| Panel: Cardiovascular | 19 |

| Panel: Other | 4 |

| 510(k) type: Traditional | 80 |

| 510(k) type: Special | 11 |

| 510(k) type: Abbreviated | 1 |

| Median FDA review time days to clearance | 149 |

| Mean FDA review time days to clearance | 155.2 |

| PCCP-authorized | 8 |

How fast were these cleared? 🔗

Review time statistics are shown below.

| 510(k) type | N | Median days | Mean days |

|---|---|---|---|

| Abbreviated | 1 | 117 | 117 |

| Special | 11 | 28 | 68.2 |

| Traditional | 80 | 153.5 | 167.6 |

Special 510(k) accounted for 11 of 92 clearances. Traditional 510(k) accounted for 80 of 92 clearances.

Manufacturer landscape with deduplication 🔗

If you look at applicant names, you’ll see 69 unique applicants. If you “deduplicate” obvious corporate families (for example: GE’s multiple legal entities, Philips’ sub-entities), the list becomes 63 manufacturer groups.

Top manufacturer groups by 2025 clearance count 🔗

| Manufacturer | 2025 Clearances | First AI/ML Clearance | First Year? |

|---|---|---|---|

| Philips | 7 | 2013 | No |

| Siemens Healthineers | 6 | 2014 | No |

| Shanghai United Imaging Healthcare Co., Ltd. | 6 | 2020 | No |

| GE HealthCare | 5 | 2018 | No |

| BrightHeart | 3 | 2024 | No |

| BunkerHill Health | 3 | 2024 | No |

| Canon | 3 | 2019 | No |

| Artrya Limited | 2 | 2025 | Yes |

| DiA Imaging Analysis Ltd. | 2 | 2024 | No |

| TeraRecon, Inc. | 2 | 2020 | No |

Incumbent imaging OEMs (Siemens, Philips, GE, Canon, Fujifilm) appear repeatedly. A large share of the long tail consists of single-clearance companies.

New entrants signal 🔗

27 of the 63 manufacturer groups appear for the first time (as a group heuristic) in 2025, contributing 28 of the 92 clearances (about 30%). Treat that as a directional signal, not a legal fact, because naming conventions and subsidiaries can hide earlier activity.

Product codes: what the volume is really about 🔗

| Product code | Count (2025) |

|---|---|

| QIH | 28 |

| IYN | 7 |

| JAK | 6 |

| LNH | 6 |

| QAS | 5 |

| DQK | 4 |

| QKB | 4 |

| QYE | 3 |

| SDJ | 2 |

| QJU | 2 |

| QHA | 2 |

| OWB | 2 |

What the top codes mean in plain English 🔗

These definitions come from FDA product classification sources.

- QIH is Automated Radiological Image Processing Software—a broad category covering AI/ML tools that process medical images.

- IYN is Ultrasonic Pulsed Doppler Imaging System—ultrasound hardware that may include AI features.

- JAK is Computed Tomography X-Ray System—CT scanner hardware, often with integrated AI capabilities.

- LNH is Nuclear Magnetic Resonance Imaging System—MRI hardware that may bundle AI functionality.

- QAS is Radiological Computer-Assisted Triage and Notification Software—AI that flags urgent findings and prioritizes worklists.

- DQK is Computer, Diagnostic, Programmable—a cardiovascular diagnostic computer category.

- QKB is Radiological Image Processing Software for Radiation Therapy—software for treatment planning, not detection/diagnosis.

- QYE is Reduced Ejection Fraction Machine Learning-Based Notification Software—a cardiovascular code (not radiological) for ECG-based heart failure screening.

This mix of hardware and software codes helps explain why a "cardiology" themed list contains so much radiology-adjacent content. In practice, many cardiac AI/ML products live operationally inside radiology infrastructure (CT, MRI, ultrasound), while others like QYE represent pure cardiovascular software that analyzes ECG signals rather than images.

PCCPs in 2025: the update cadence story is real 🔗

8 clearances in 2025 were PCCP-authorized.

| decisiondate | knumber | applicant | devicename | productcode | type |

|---|---|---|---|---|---|

| 2025-09-11 | K250507 | Apple Inc. | Hypertension Notification Feature (HTNF) | QXO | Traditional |

| 2025-04-04 | K242807 | Deski | HeartFocus (V.1.1.1) | QJU | Traditional |

| 2025-07-28 | K250652 | Anumana, Inc. | ECG-AI Low Ejection Fraction (LEF) 12-Lead algorithm (1010) | QYE | Traditional |

| 2025-01-15 | K243065 | Caption Health, Inc. | Cardiac Guidance | QJU | Traditional |

| 2025-05-07 | K243684 | BrightHeart | BrightHeart View Classifier | QIH | Traditional |

| 2025-06-05 | K251456 | BrightHeart | BrightHeart View Classifier | QIH | Special |

| 2025-07-18 | K250902 | HeartFlow, Inc. | HeartFlow Analysis | PJA | Traditional |

| 2025-04-03 | K242551 | Siemens Healthcare GmbH | syngo Dynamics (Version VA41D) | QIH | Traditional |

PCCP allows manufacturers to make certain pre-specified changes to their device without submitting a new 510(k). It requires a quality system capable of monitoring and change management.

Coronary CT: CAC, Plaque, and CT-FFR Clearances 🔗

2025 clearance count for three coronary CT sub-areas 🔗

- Plaque quantification / plaque characterization: 9 cleared devices

- CAC / coronary calcium scoring: 7 cleared devices

- FFR / FFRct / QFR: 3 cleared devices

These counts are directional estimates based on device names and intended use descriptions.

Plaque-related devices (2025) 🔗

| decisiondate | knumber | applicant | devicename | productcode | type |

|---|---|---|---|---|---|

| 2025-03-07 | K242338 | Cleerly, Inc. | Cleerly LABS (v2.0) | QIH | Special |

| 2025-03-27 | K243038 | Artrya Limited | Salix Central | QIH | Traditional |

| 2025-05-14 | K242624 | Shanghai United Imaging Healthcare Co., Ltd. | Medical Image Post-processing Software (uOmnispace.CT) | QIH | Traditional |

| 2025-06-18 | K243672 | GE Medical Systems SCS | CardIQ Suite | JAK | Traditional |

| 2025-07-18 | K250902 | HeartFlow, Inc. | HeartFlow Analysis | PJA | Traditional |

| 2025-08-20 | K251837 | Artrya Limited | Salix Coronary Plaque (V1.0.0) | QIH | Traditional |

| 2025-09-04 | K251656 | Careverse Technology Pte. Ltd. | Careverse CoronaryDoc (Careverse CoronaryDoc) | QIH | Traditional |

| 2025-10-27 | K251027 | Circle Cardiovascular Imaging Inc. | cvi42 Coronary Plaque Software Application | QIH | Traditional |

| 2025-11-28 | K252217 | Canon Medical Informatics, Inc. | CT VScore+ | JAK | Traditional |

CAC-related devices (2025) 🔗

| decisiondate | knumber | applicant | devicename | productcode | type |

|---|---|---|---|---|---|

| 2025-01-27 | K243229 | BunkerHill Health | Bunkerhill AVC | JAK | Traditional |

| 2025-03-27 | K243038 | Artrya Limited | Salix Central | QIH | Traditional |

| 2025-05-14 | K242624 | Shanghai United Imaging Healthcare Co., Ltd. | Medical Image Post-processing Software (uOmnispace.CT) | QIH | Traditional |

| 2025-06-18 | K243672 | GE Medical Systems SCS | CardIQ Suite | JAK | Traditional |

| 2025-08-20 | K251837 | Artrya Limited | Salix Coronary Plaque (V1.0.0) | QIH | Traditional |

| 2025-10-23 | K250288 | TeraRecon, Inc. | TeraRecon Cardiovascular.Calcification.CT | QIH | Traditional |

| 2025-11-28 | K252217 | Canon Medical Informatics, Inc. | CT VScore+ | JAK | Traditional |

FFR-related devices (2025) 🔗

| decisiondate | knumber | applicant | devicename | productcode | type |

|---|---|---|---|---|---|

| 2025-04-04 | K243769 | QFR Solutions bv | QFR (3.0) | QHA | Traditional |

| 2025-07-18 | K250902 | HeartFlow, Inc. | HeartFlow Analysis | PJA | Traditional |

| 2025-10-17 | K251355 | SpectraWAVE, Inc. | X1-FFR | QHA | Traditional |

Beyond Coronary CT: Other Notable 2025 Trends 🔗

1) Heart failure and low ejection fraction screening 🔗

Multiple 2025 clearances involve EF estimation or low EF screening.

Representative example:

- Tempus ECG-Low EF (Tempus AI) cleared in 2025.

Eko Health raised a growth round in 2025 (reported publicly).

2) Valvular disease 🔗

Valvular analysis shows up repeatedly. Echo remains a common modality for structural heart imaging. AI features often focus on chamber quantification, measurement automation, and quality support.

3) ECG AI and consumer-grade screening 🔗

Apple's hypertension notification feature (K250507) was cleared in 2025 and is PCCP-authorized.

4) Workflow and triage tools 🔗

Product code QAS (triage/notification) appeared in 5 clearances in 2025.

Financing Events Near 2025 Clearances 🔗

Below are case studies showing FDA clearances alongside publicly reported financing and corporate events.

Case study: HeartFlow 🔗

Timeline (public sources) 🔗

- March 26, 2025: HeartFlow reported raising $98 million via a convertible note financing (Reuters coverage).

- July 17, 2025: HeartFlow filed for a U.S. IPO (Reuters).

- July 18, 2025: HeartFlow Analysis received FDA clearance (K250902).

- August 2025: HeartFlow's IPO pricing and debut were covered by Reuters, including a reported valuation and proceeds.

Case study: Cleerly 🔗

Timeline (public sources) 🔗

- December 2024: Cleerly announced $106 million in growth financing (public reporting).

- December 2024: Cleerly announced the AMA CPT Editorial Panel approved a Category I CPT code 75577 for plaque analysis from CCTA, effective January 1, 2026 (company announcement).

- March 7, 2025: Cleerly LABS v2.0 received FDA clearance (K242338).

Case study: Anumana 🔗

Timeline (public sources) 🔗

- Anumana has received multiple Breakthrough Device Designations for ECG-AI use cases (publicly discussed).

- Anumana announced a Series C financing and strategic collaborations, including Boston Scientific participation and Mayo Clinic Platform collaboration (Business Wire reporting).

- July 28, 2025: ECG-AI Low Ejection Fraction (LEF) 12-Lead algorithm received FDA clearance (K250652).

Case study: Eko Health 🔗

- June 5, 2024: $41 million in Series D financing

- August 12, 2025: Eko Duo ECG System received FDA clearance (K251494).

Case Study: Artrya 🔗

- Nov 26, 2021: Artrya began trading on the ASX. BioWorld reported the IPO offer price was A$1.35 and the stock closed its first trading day at A$1.52 (public reporting).

- Jun 24, 2022: The FDA rejected Artrya’s 510(k) for Salix Coronary Anatomy, citing not substantially equivalent to the chosen predicate (public reporting).

- Jul 26, 2022: In an ASX quarterly update, Artrya stated the FDA advised in June 2022 that the company’s 510(k) application was not approved because the device was not substantially equivalent, and that the FDA invited resubmission (company announcement).

- Mar 27, 2025: Artrya reported that the FDA cleared Salix Coronary Anatomy for commercial sale in the U.S. (company announcement). The FDA 510(k) documentation for K243038 supports this clearance context (FDA documentation).

- Aug 20, 2025: FDA 510(k) K251837 for Salix Coronary Plaque (V1.0.0) lists Artrya as the applicant (FDA database).

- Aug 21, 2025: Artrya announced it received FDA 510(k) clearance for the Salix Coronary Plaque module (company announcement). The FDA 510(k) summary document for K251837 provides the supporting clearance documentation (FDA documentation).

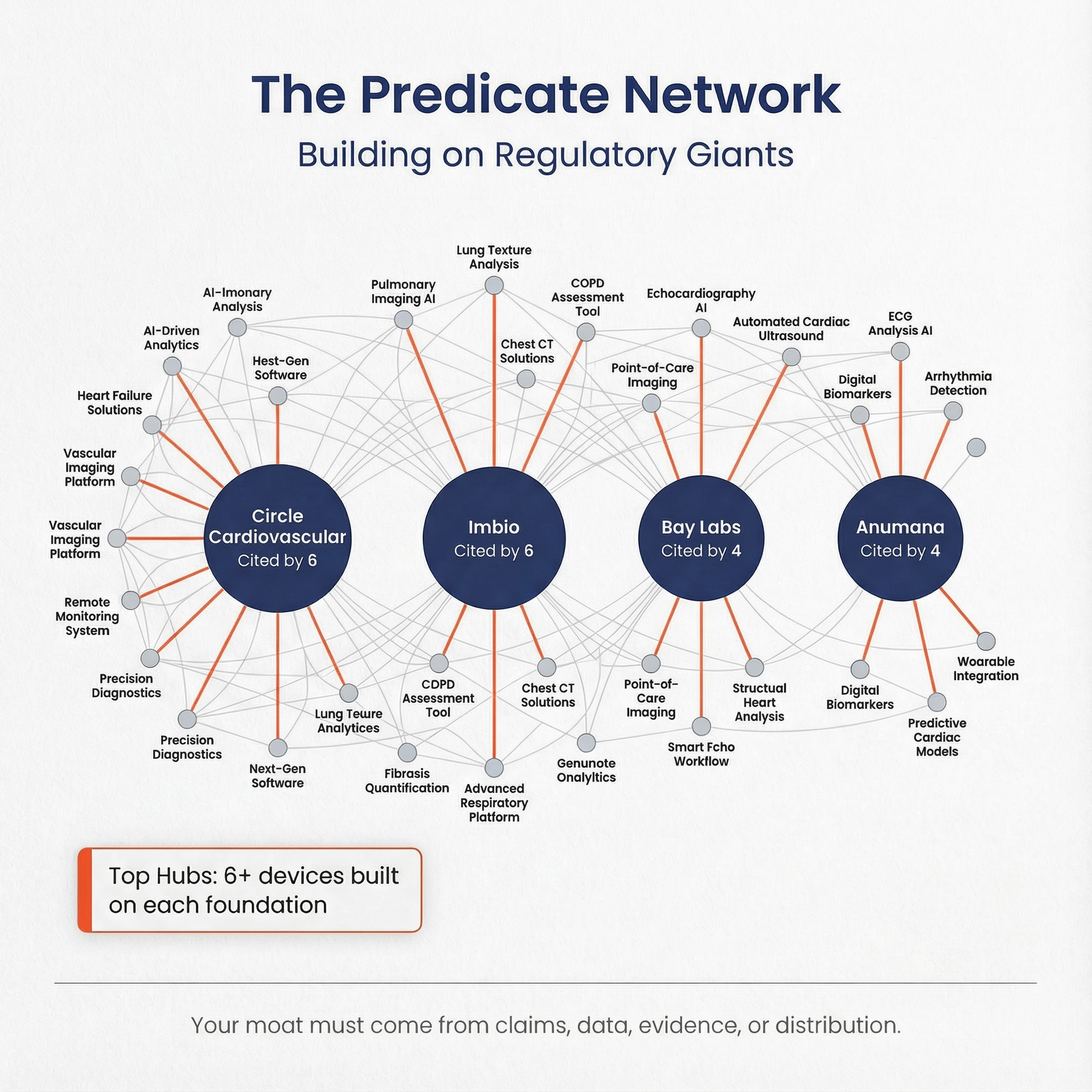

Predicate network analysis: which devices are the “hubs”? 🔗

Top “predicated by” devices (direct) 🔗

| knumber | year | applicant | devicename | productcode | direct_cited_by | indirect_cited_by |

|---|---|---|---|---|---|---|

| K213998 | 2022 | Circle Cardiovascular Imaging Inc | cvi42 Auto Imaging Software Application | QIH | 6 | 7 |

| K203256 | 2021 | Imbio, LLC | Imbio RV/LV Software | QIH | 6 | 9 |

| DEN190040 | 2020 | Bay Labs, Inc. | Caption Guidance | QJU | 4 | 5 |

| K232699 | 2023 | Anumana, Inc. | Low Ejection Fraction AI-ECG Algorithm | QYE | 4 | 4 |

| K222463 | 2022 | Ultromics Limited | EchoGo Heart Failure | QUO | 4 | 6 |

| K210085 | 2021 | Zebra Medical Vision Ltd. | HealthCCSng | JAK | 4 | 7 |

| K230223 | 2023 | Bunkerhill, Inc | iCAC Device | JAK | 3 | 3 |

| K173780 | 2018 | Bay Labs, Inc. | EchoMD Automated Ejection Fraction Software | LLZ | 3 | 10 |

| K201555 | 2020 | Ultromics Ltd | EchoGo Pro | POK | 3 | 4 |

| K210791 | 2021 | eko.ai Pte. Ltd. d/b/a Us2.ai | Us2.v1 | QIH | 3 | 3 |

Prediction 🔗

Cardiology AI/ML clearance volume increased from 62 (2024) to 92 (2025). A simple growth extrapolation suggests 2026 could land around 95 to 125 decisions in cardiology AI/ML.

Need Help? Let’s Chat! 🔗

Regulatory hurdles shouldn't stall your innovation. Let’s get you FDA cleared in 2026. More and more competitors are arriving on the scene and we don’t want you to be left behind.

Already on the market? You need to protect your market share by accelerating your regulatory clearance process and culture. Hire us for one of our done-for-you services so we can teach your team how it is done.

Innolitics guarantees 510(k) clearance if:

- Your algorithm passes our suggested acceptance criteria as we determine during our regulatory strategy and presub service

- And getting FDA clearance is one of the top priorities of your organization

Innolitics guarantees 510(k) submission timeline if :

- Your algorithm is complete and can be containerized or be packaged as an SDK

- And you allow us to project manage the submission and allow us to communicate directly with your engineers

- And getting FDA clearance is one of the top priorities of your organization