Executive Summary 🔗

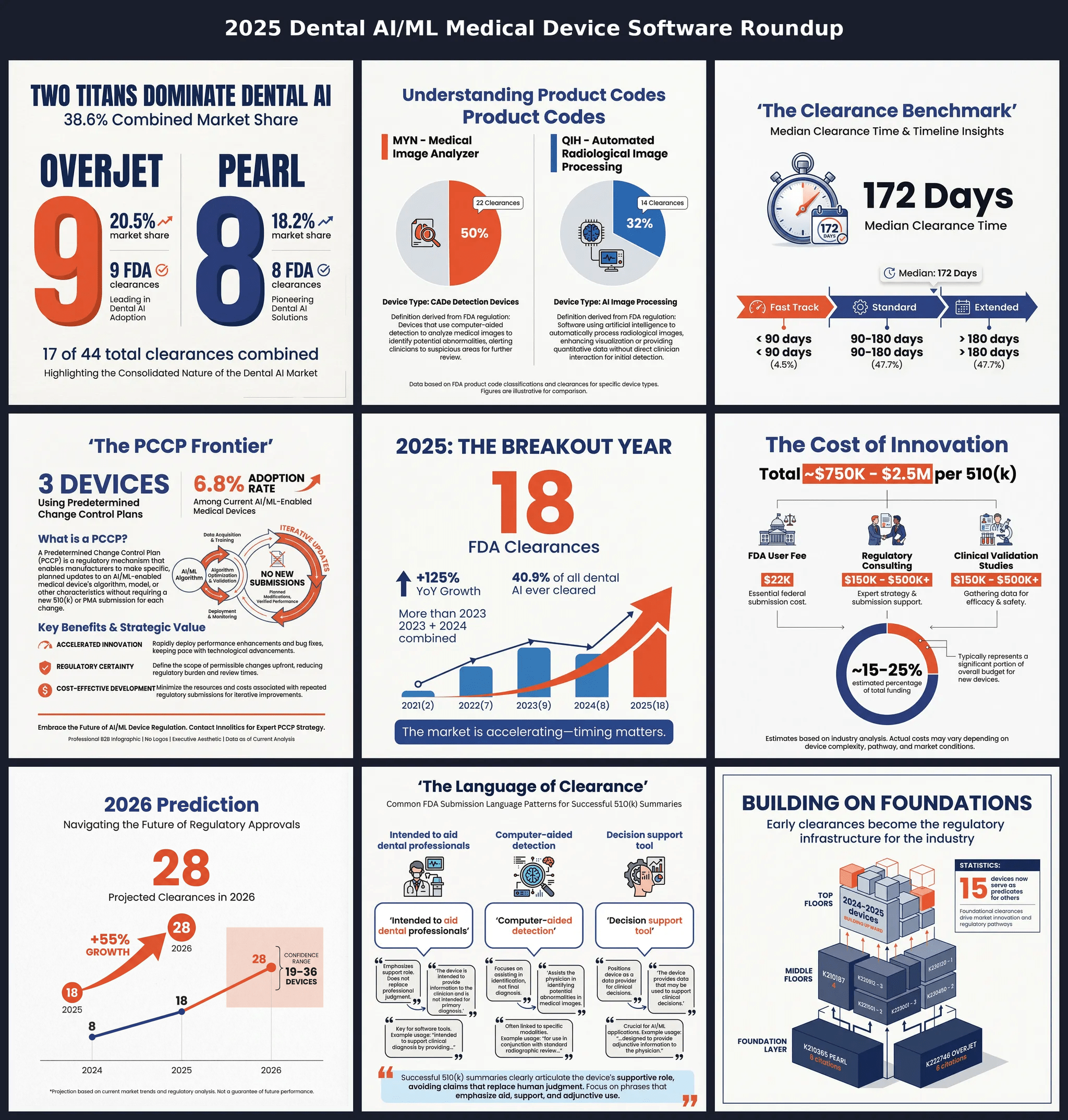

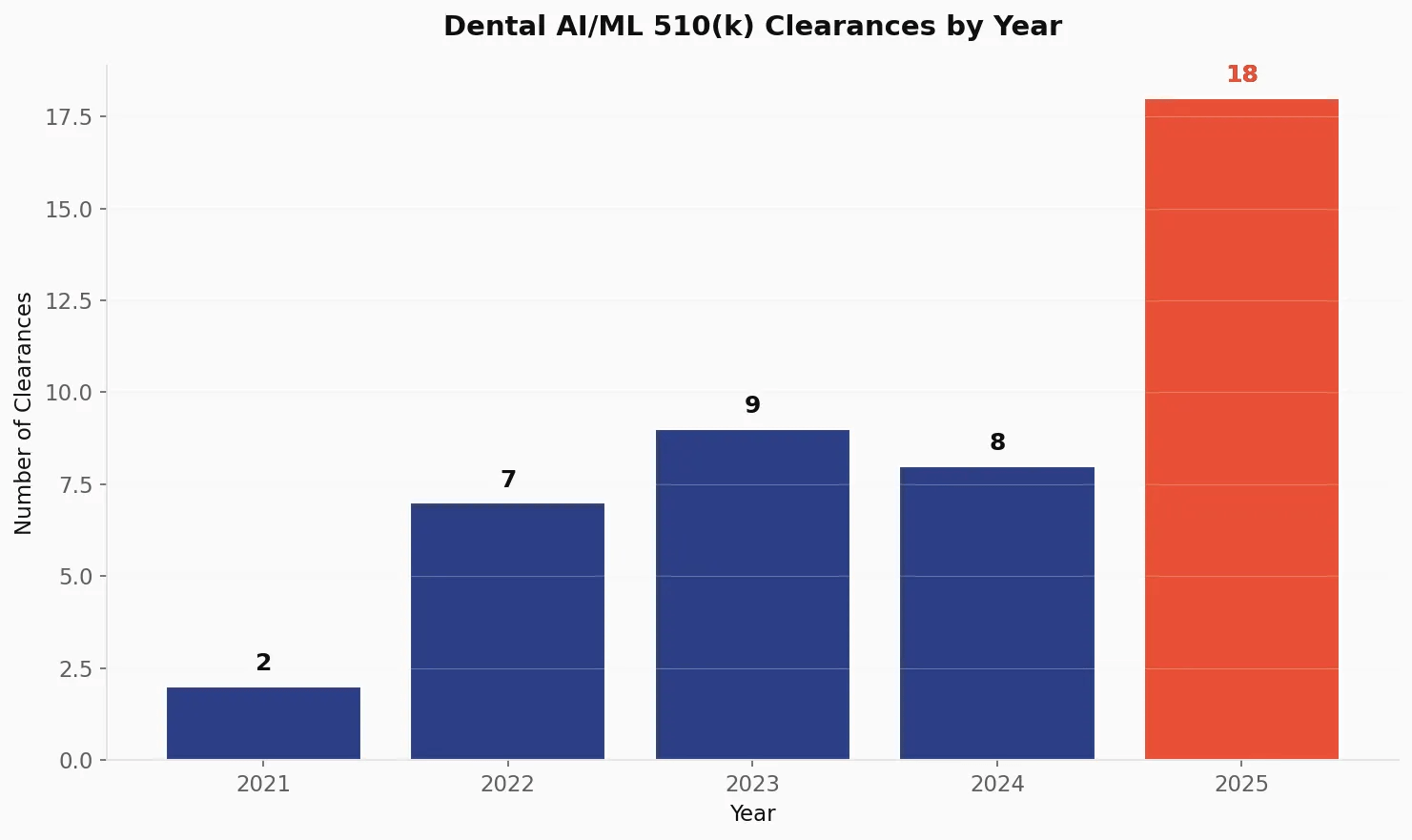

Artificial intelligence in dentistry has transitioned from experimental technology to clinical reality. This analysis of FDA 510(k) clearance data shows a market at a turning point, with 44 AI/ML-powered dental Software as Medical Devices (SaMD) cleared between May 2021 and December 2025. The year 2025 alone accounts for 18 clearances—more than the previous two years combined.

We'll look at the companies leading the charge, the regulatory pathways they use, the predicate network shaping competition, the clinical applications gaining traction, and the economics of bringing these innovations to market.

Please note, we used AI to identify these devices. While we spot checked everything, we may have missed some devices. However, we feel the executive level directional insights are still valid even though some of the numbers may be a little off.

Limitations:

- Company name variations in FDA records may affect exact counts

- Some devices may have dental applications but be classified under different panels

- Funding data is based on publicly available information and may be incomplete

- Cost estimates are based on industry analysis and may vary significantly

Part I: The Growth Trajectory 🔗

The Rise 🔗

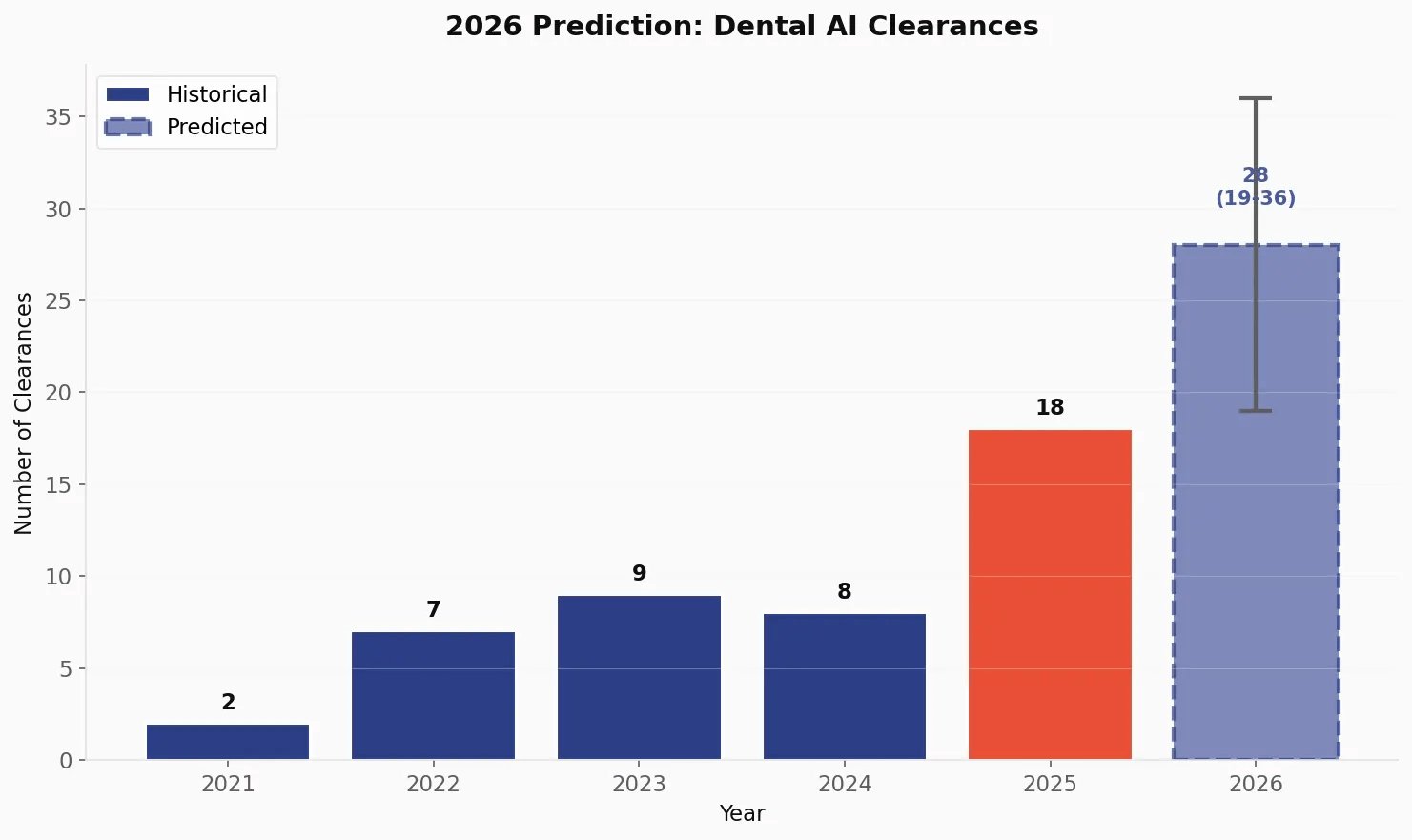

The dental AI market picked up speed fast. After starting with just 2 clearances in 2021, the industry has since grown and will just had its largest jump yet.

| Year | Clearances | YoY Growth | Cumulative Total |

|---|---|---|---|

| 2021 | 2 | — | 2 |

| 2022 | 7 | +250% | 9 |

| 2023 | 9 | +29% | 18 |

| 2024 | 8 | -11% | 26 |

| 2025 | 18 | +125% | 44 |

The 2025 surge stands out. With 18 clearances representing 40.9% of all dental AI devices ever cleared, this single year changed the board. The slight dip in 2024 looks like a temporary pause before the jump.

Quarterly Momentum 🔗

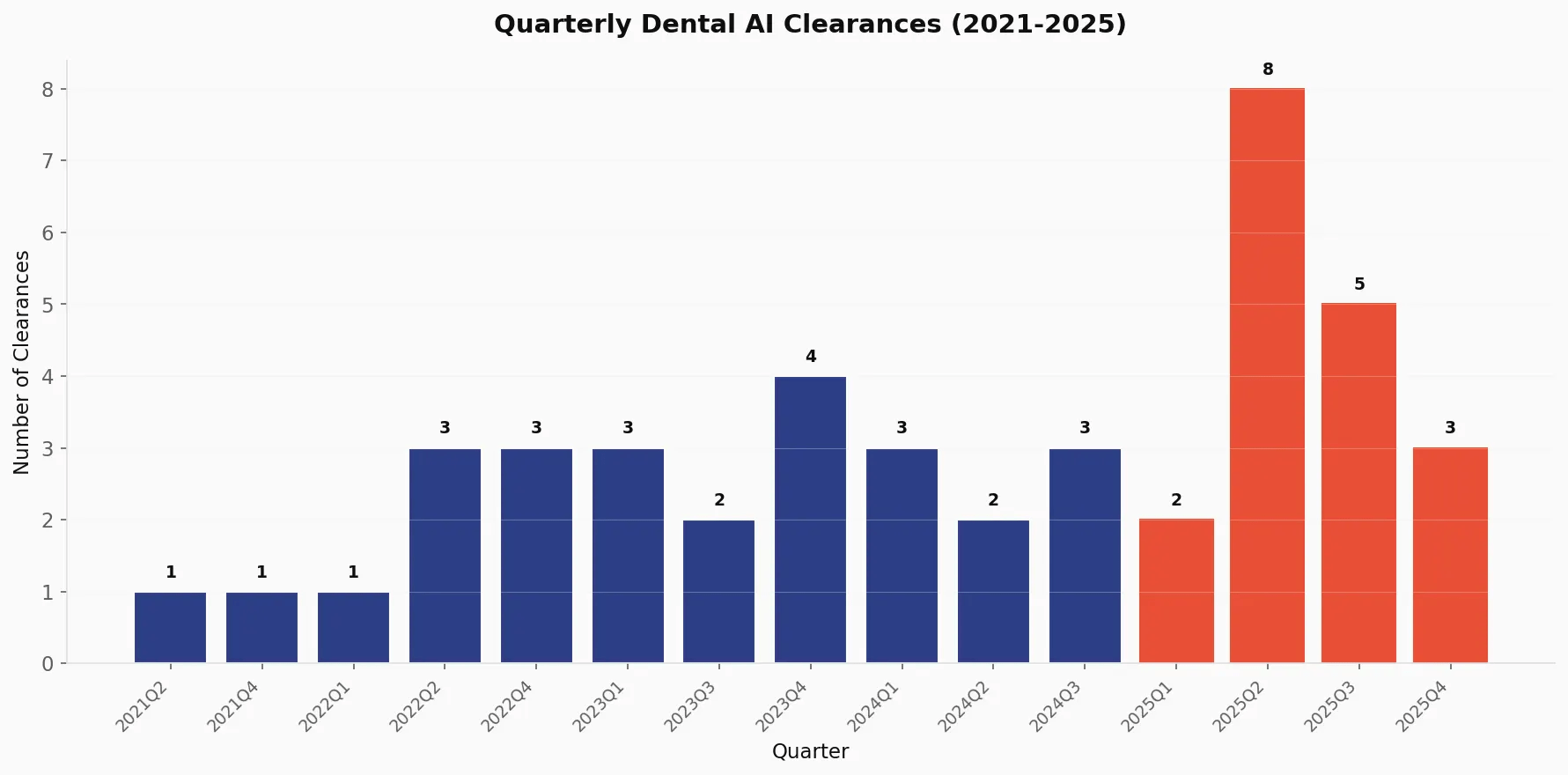

Examining the quarterly data reveals interesting patterns in regulatory timing:

| Quarter | Clearances | Notable Trend |

|---|---|---|

| Q2 2025 | 8 | Peak quarter in history |

| Q3 2025 | 5 | Sustained momentum |

| Q4 2025 | 3 | Year-end completions |

| Q4 2023 | 4 | Previous peak |

The concentration of clearances in Q2 2025 (8 devices) suggests a bolus of submissions happened in Q4 or 2024.

Part II: The Competitive Landscape 🔗

Market Leaders: A Two-Horse Race 🔗

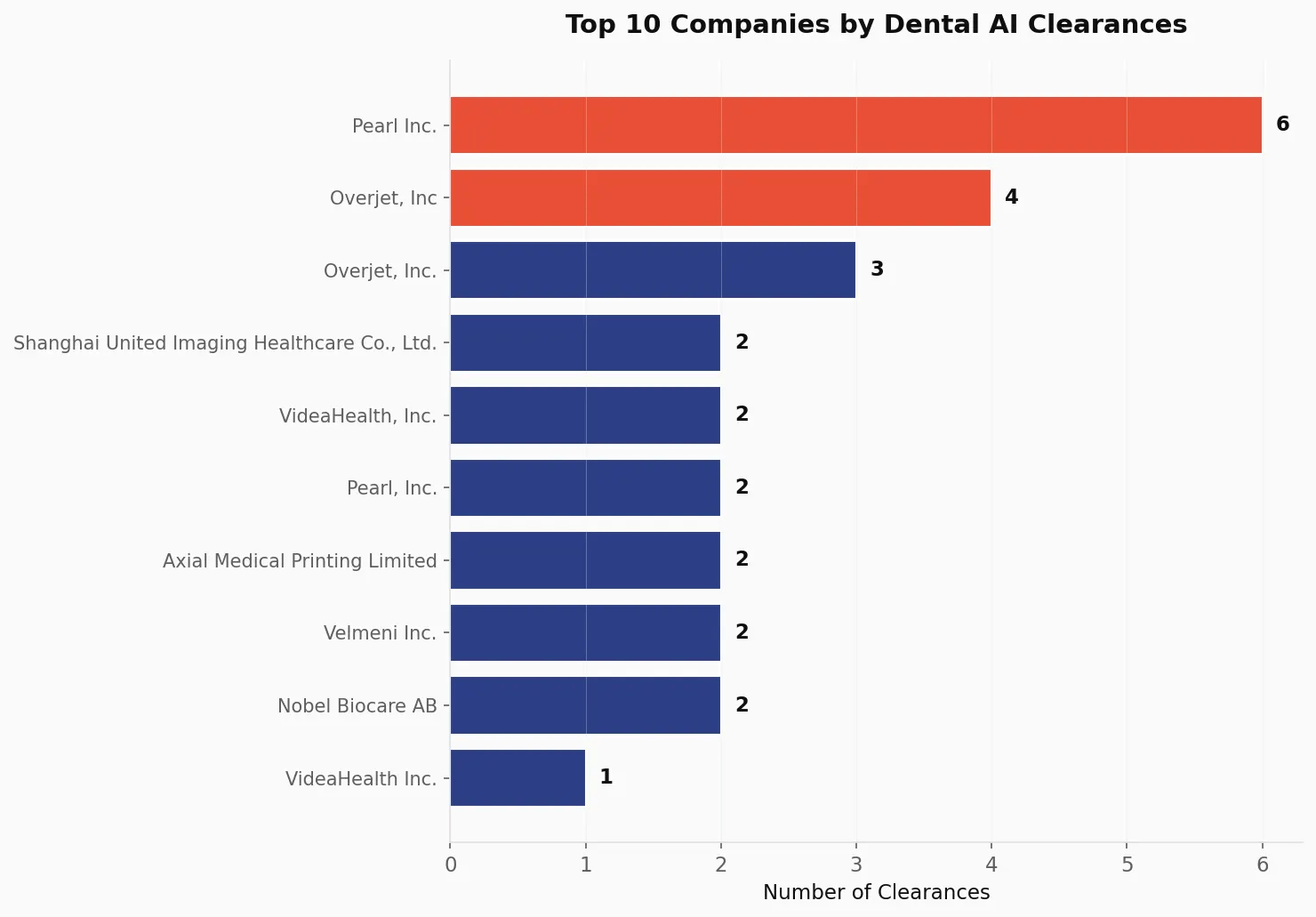

Two companies dominate the dental AI space:

Pearl Inc. leads with 8 clearances (combining "Pearl Inc." and "Pearl, Inc." entries), taking 18.2% of all cleared devices. Their portfolio spans both MYN (Medical Image Analyzer) and QIH (Automated Radiological Image Processing) product codes.

Overjet, Inc. follows closely with 7 clearances (combining variant company name entries), accounting for 15.9% of the market. Overjet stands out for speed, with an average clearance time of just 98 days for their most recent submissions—way below the industry median of 172 days.

| Company | Clearances | Market Share | First Clearance | Avg. Clearance Time |

|---|---|---|---|---|

| Pearl Inc. | 8 | 18.2% | March 2022 | 247 days |

| Overjet, Inc. | 7 | 15.9% | May 2021 | 146 days |

| VideaHealth | 3 | 6.8% | February 2023 | 116 days |

| Shanghai United Imaging | 2 | 4.5% | May 2024 | 242 days |

| Velmeni Inc. | 2 | 4.5% | 2024 | — |

| Axial Medical Printing | 2 | 4.5% | 2024 | — |

| Nobel Biocare AB | 2 | 4.5% | 2024 | — |

Together, Pearl and Overjet control approximately 34% of all dental AI clearances—a significant concentration that reflects both their early-mover advantage and sustained investment in regulatory execution.

The Rising Challengers 🔗

Beyond the top two, several companies are positioning for growth:

VideaHealth is a serious contender with 3 clearances and efficient regulatory execution (116-day average). Their focus on AI-powered diagnostics positions them well for the expanding caries detection market.

Shanghai United Imaging Healthcare shows the growing international side of dental AI, bringing Chinese innovation to the US market through the 510(k) pathway.

Axial Medical Printing combines AI with 3D printing and surgical planning.

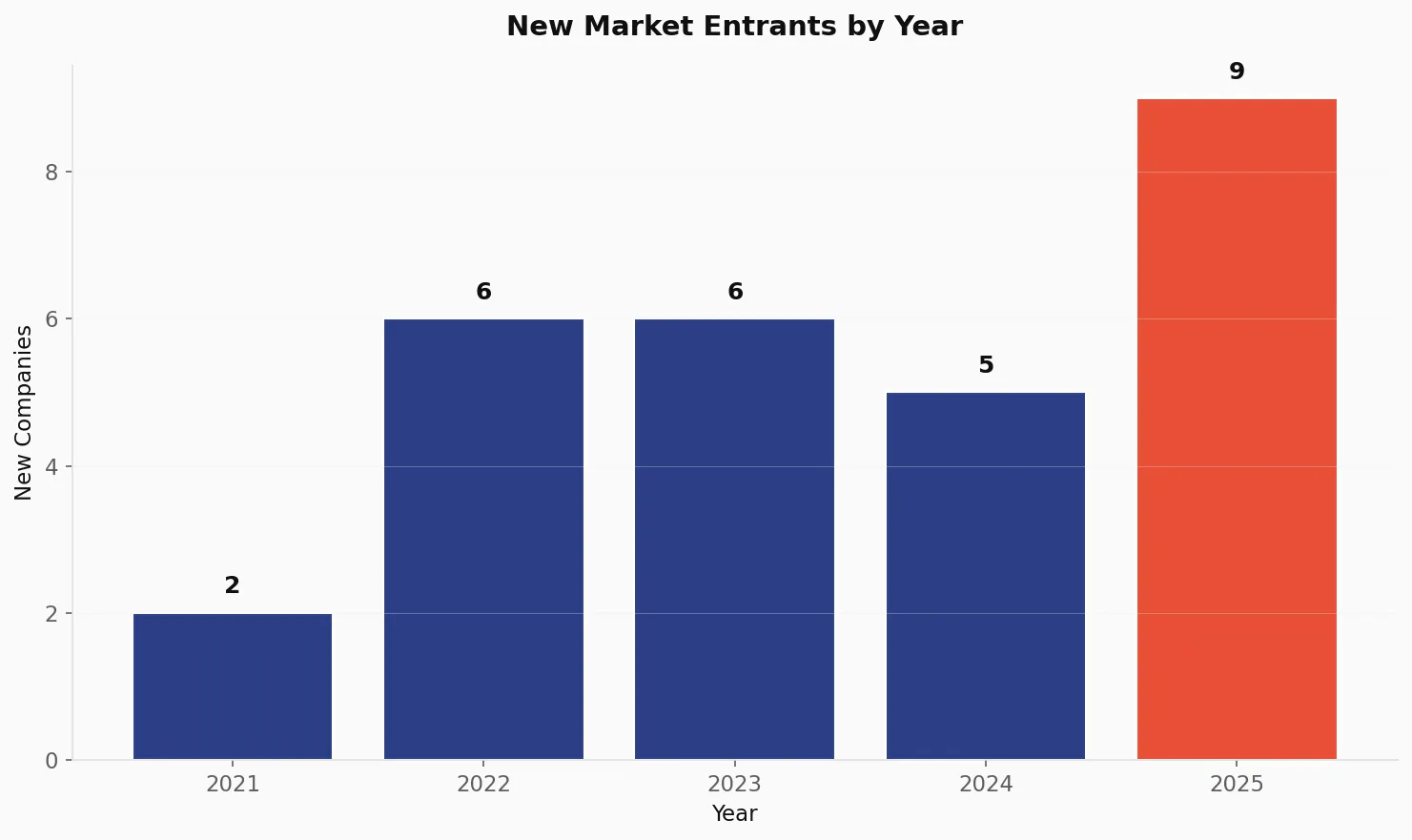

New Market Entrants 🔗

The ecosystem continues to attract new players:

| Year | New Companies Entering | Cumulative Companies |

|---|---|---|

| 2021 | 2 | 2 |

| 2022 | 6 | 8 |

| 2023 | 6 | 14 |

| 2024 | 5 | 19 |

| 2025 | 9 | 28 |

The 9 new entrants in 2025 represent the largest single-year influx of new companies, suggesting the market opportunity is attracting significant entrepreneurial and corporate attention.

Part III: Regulatory Pathways and Timing 🔗

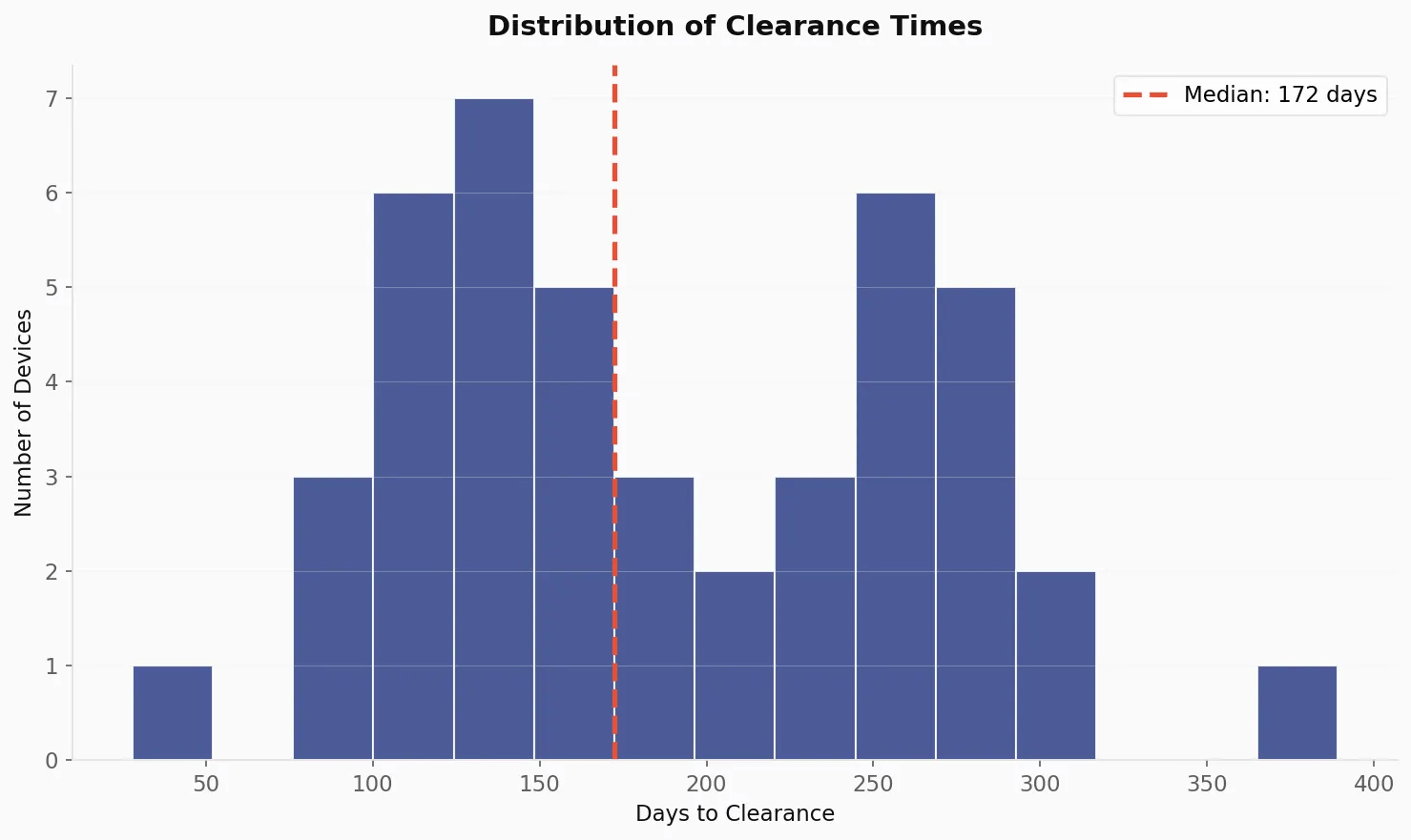

The 172-Day Benchmark 🔗

Understanding regulatory timelines is critical for strategic planning. Our analysis reveals:

| Metric | Days |

|---|---|

| Median | 172 |

| Mean | 189 |

| Minimum | 28 |

| Maximum | 389 |

| Standard Deviation | 78 |

The distribution varies a lot, with clearance times ranging from 28 days to nearly 13 months. This variability shows why submission quality and regulatory strategy matter.

Speed Categories 🔗

| Category | Days | Count | Percentage |

|---|---|---|---|

| Fast Track | <90 | 2 | 4.5% |

| Standard | 90-180 | 21 | 47.7% |

| Extended | >180 | 21 | 47.7% |

Nearly half of all submissions take longer than 6 months, highlighting the complexity of AI/ML device review. However, the existence of fast-track clearances (under 90 days) demonstrates that well-prepared submissions can achieve rapid market entry.

Quartile Analysis 🔗

| Percentile | Days | Interpretation |

|---|---|---|

| 25th | 132 | Top performers |

| 50th (Median) | 172 | Industry standard |

| 75th | 260 | Extended review |

Companies in the top quartile (under 132 days) have mastered the process. Their submissions share common success factors: clear predicate selection, comprehensive performance data, and well-defined intended use statements.

Third-Party Review and Expedited Pathways 🔗

Notably, 100% of dental AI devices went through standard FDA review rather than third-party review organizations. Similarly, no devices received expedited review designation. This suggests that dental AI, while innovative, is not being prioritized under breakthrough or expedited pathways—manufacturers should plan for standard review timelines.

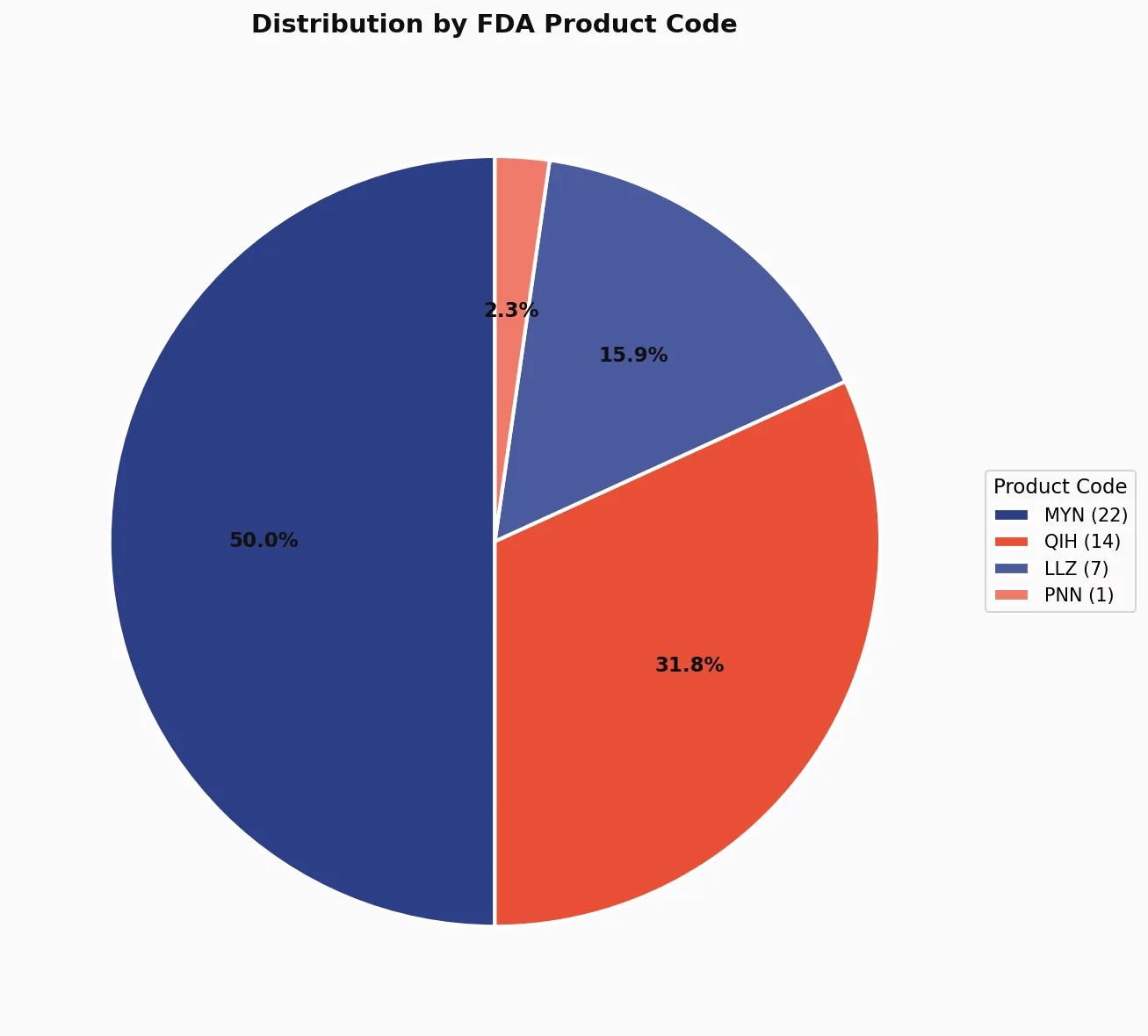

Part IV: Product Code Analysis 🔗

Understanding MYN and QIH

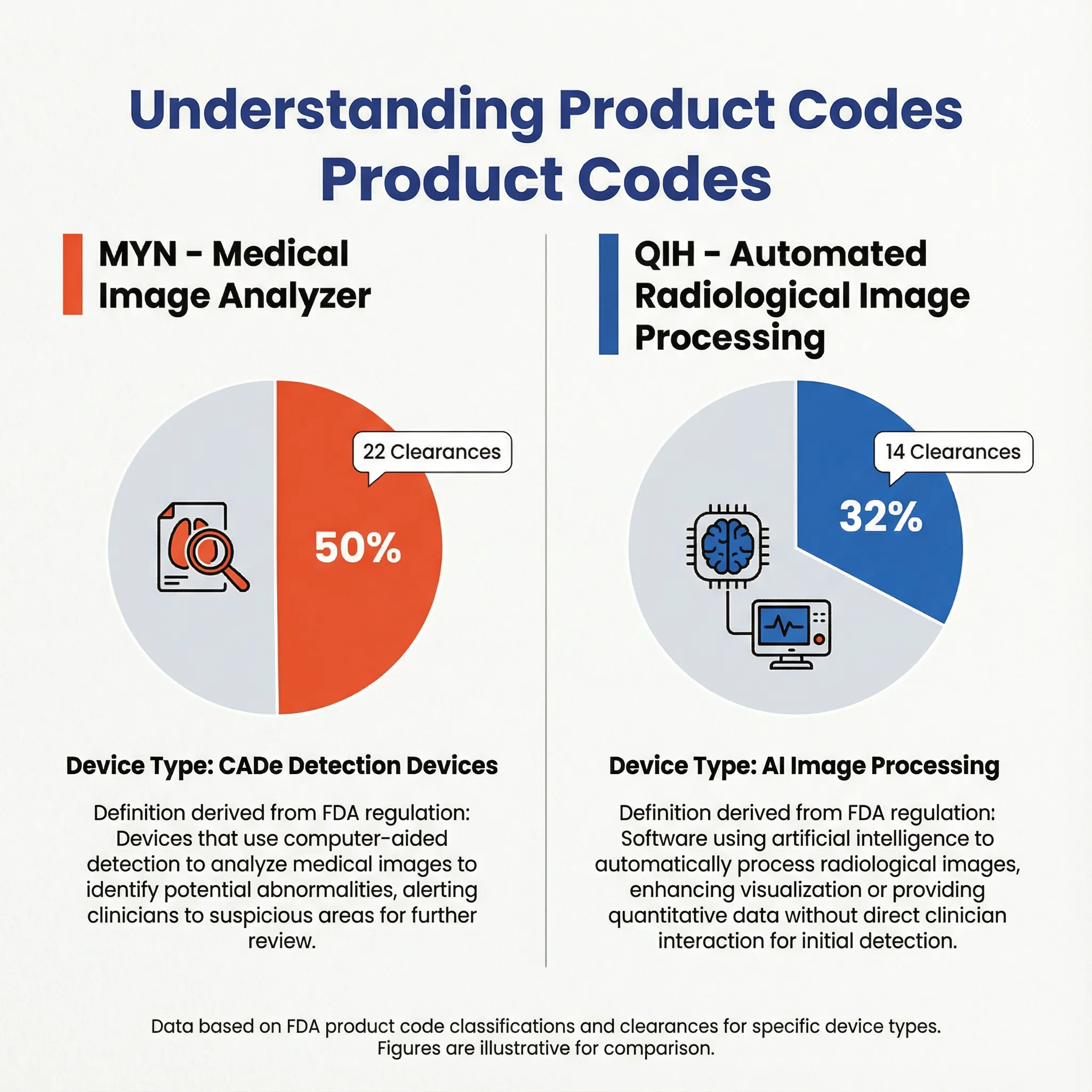

Two FDA product codes dominate the dental AI landscape:

MYN - Medical Image Analyzer (22 clearances, 50%)

The MYN product code (regulation number 892.2070) covers Computer-Aided Detection (CADe) devices. These systems are designed to identify and highlight potential abnormalities in radiological images, directing the clinician's attention to areas that may warrant further review.

In the dental context, MYN devices typically:

- Automatically detect potential caries on bitewing and periapical radiographs

- Highlight areas of concern for clinician review

- Provide visual overlays or annotations on dental images

- Function as a "second reader" to augment clinical judgment

QIH - Automated Radiological Image Processing Software (14 clearances, 32%)

The QIH product code (regulation number 892.2050) covers AI-powered software for image processing and analysis. These devices provide the foundational image enhancement and processing capabilities that enable more advanced diagnostic functions.

QIH devices in dentistry typically:

- Enhance image quality and contrast

- Automate image processing workflows

- Provide measurement and analysis tools

- Enable integration with practice management systems

LLZ - System, Image Processing, Radiological (7 clearances, 16%)

The LLZ code covers general image management and processing systems, representing a broader category that includes some AI-enhanced functionality.

| Product Code | Count | Percentage | Primary Function |

| MYN | 22 | 50.0% | CADe - Detection |

| QIH | 14 | 31.8% | Image Processing |

| LLZ | 7 | 15.9% | Image Management |

| PNN | 1 | 2.3% | Other |

The dominance of MYN reflects the market's focus on detection-oriented AI—systems designed to find pathology that might otherwise be missed.

Part V: Inside the 510(k) Summaries 🔗

The Language of Clearance

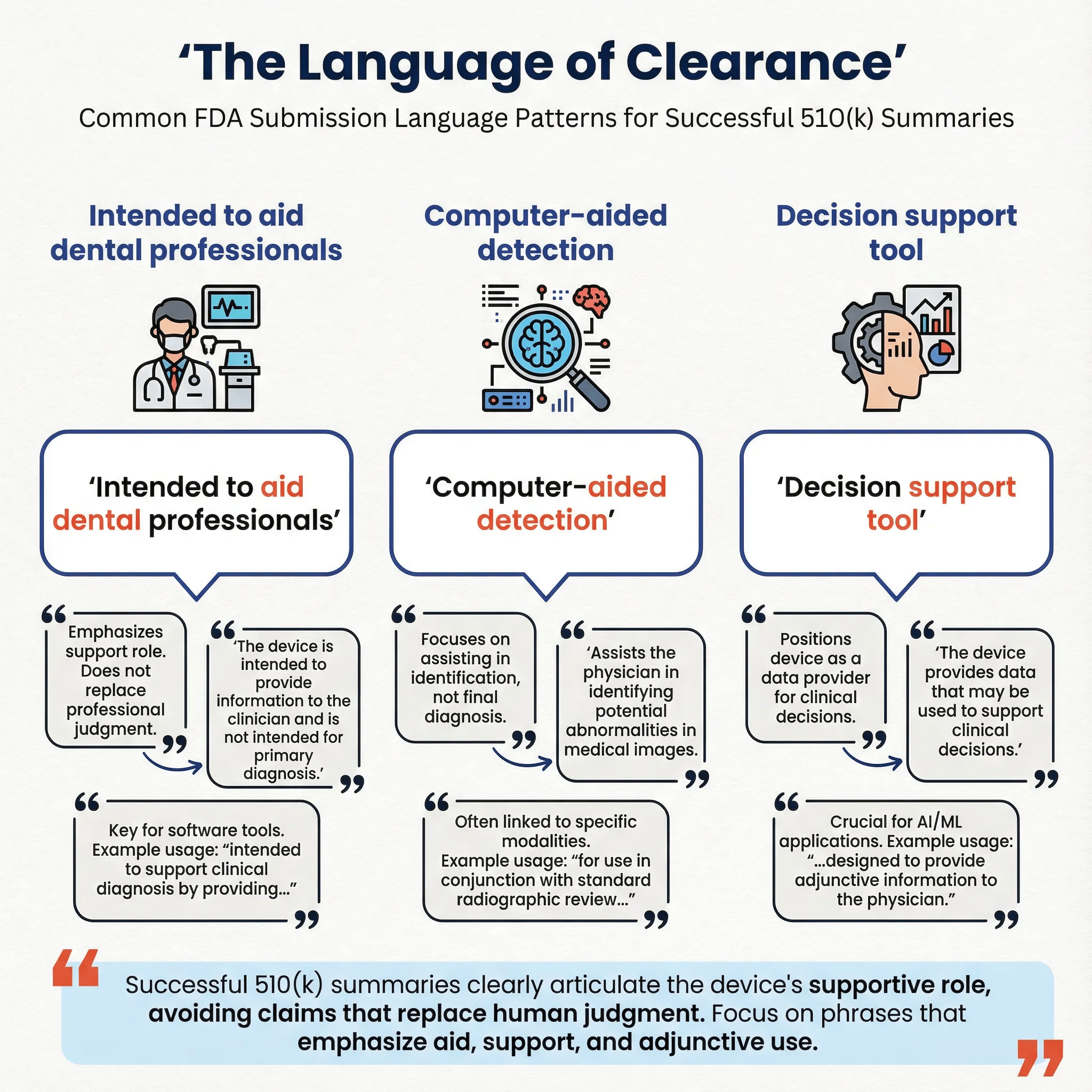

Analysis of 510(k) summary documents reveals consistent patterns in how successful submissions frame their intended use:

| Phrase | Frequency | Strategic Implication |

| "radiograph" | 72.7% | Anchors device to established imaging modality |

| "periapical" | 61.4% | Specifies image type for clear scope |

| "assist" | 54.5% | Positions AI as decision support |

| "detection" | 54.5% | Defines primary function |

| "bitewing" | 54.5% | Specifies image type |

| "dentist" | 50.0% | Identifies intended user |

| "caries" | 43.2% | Specifies target condition |

| "clinical judgment" | 36.4% | Preserves clinician authority |

| "aid in" | 27.3% | Alternative to "assist" |

| "panoramic" | 25.0% | Broader imaging scope |

The consistent use of phrases like "assist" and "aid in" (combined 81.8%) reflects a deliberate regulatory strategy: positioning AI as a decision support tool rather than an autonomous diagnostic agent. This framing is critical for regulatory acceptance and clinical adoption.

Target Conditions

The intended use statements reveal clear clinical priorities:

| Condition | Frequency | Clinical Significance |

| Caries | 43.2% | Most common dental pathology |

| Calculus | 15.9% | Periodontal health indicator |

| Periapical radiolucencies | 25.0% | Endodontic pathology |

| Bone loss | 6.8% | Periodontal disease progression |

Caries detection dominates the market, reflecting both the clinical prevalence of dental decay and the relatively well-defined nature of the detection task. Interproximal caries—cavities forming between teeth—are particularly amenable to AI detection due to their characteristic radiographic appearance.

Common Acceptance Criteria

While specific values vary by device, successful submissions demonstrate performance through standardized metrics:

| Metric | Typical Range | Interpretation |

| Sensitivity | 86% - 91% | True positive rate |

| Specificity | 79% - 89% | True negative rate |

| AUC | 0.85 - 0.95 | Overall discrimination |

These metrics are typically validated through retrospective reader studies using a pre-defined ground truth established by consensus of board-certified dental radiologists or oral surgeons.

Part VI: The Predicate Network — Building on Regulatory Foundations 🔗

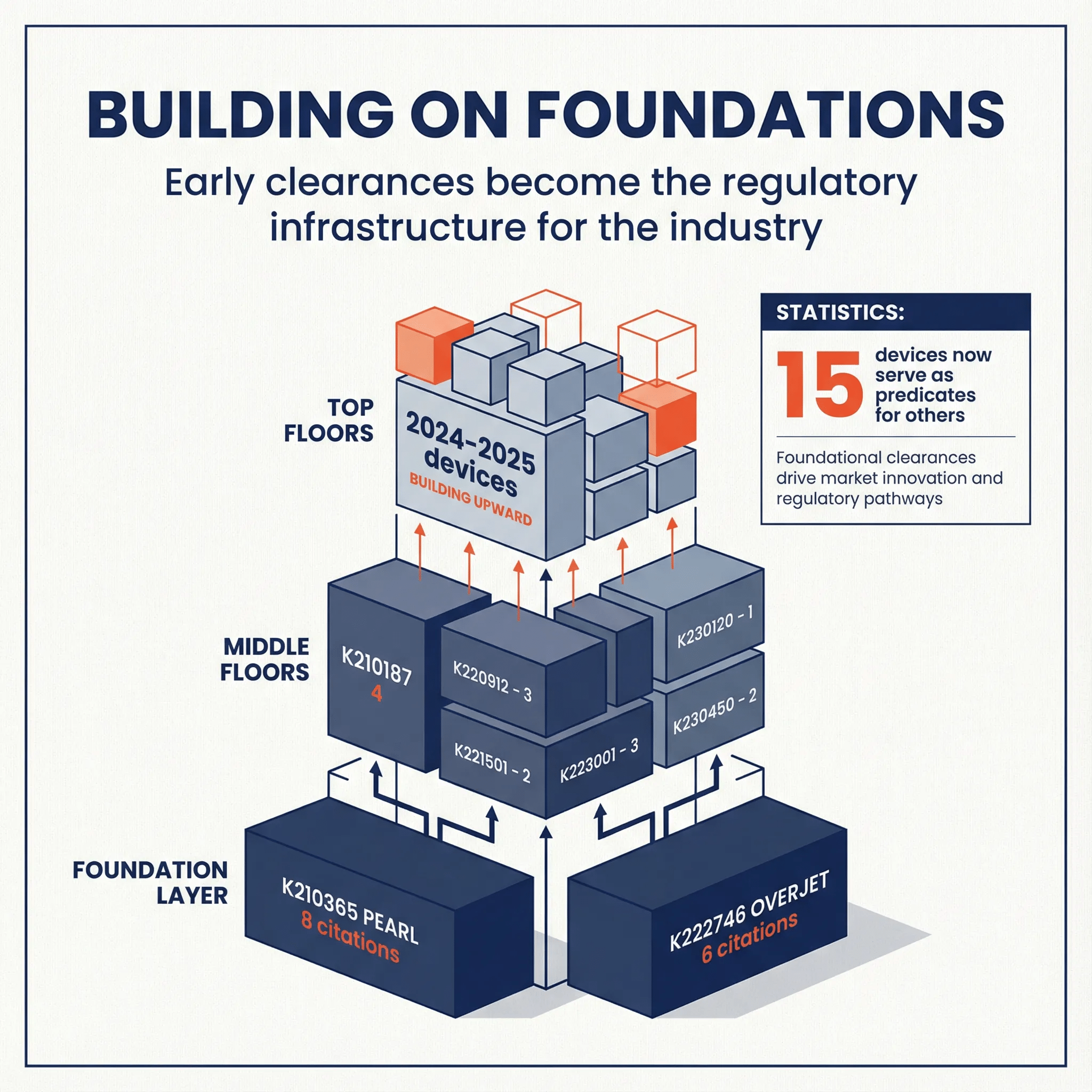

Every FDA 510(k) clearance needs a foundation. The substantial equivalence pathway requires manufacturers to prove their device is as safe and effective as a legally marketed predicate device. In dental AI, these relationships form a complex network that shows the regulatory lineage—and competitive dynamics—of the whole market.

The Architecture of Regulatory Influence

Our analysis of all 44 dental AI 510(k) clearances shows a highly connected ecosystem where early movers don't just gain market access—they become the foundation competitors must build on.

| Metric | Value |

| Total Dental AI Devices Analyzed | 44 |

| External (Non-Dental-AI) Predicates | 26 |

| Total Predicate Relationships | 59 |

| Dental AI Devices Now Serving as Predicates | 15 |

| Average Predicates Cited per Device | 1.34 |

The data is clear: 34% of all dental AI devices (15 of 44) have become predicates for subsequent clearances. More than one-third of the market now builds on foundations laid by dental AI pioneers rather than external devices from adjacent categories.

The Foundation Layer: First-Mover Advantage is Regulatory

At the base of the dental AI regulatory structure sit two companies whose early clearances have become industry infrastructure:

| K Number | Company | Device | Year | Citations as Predicate |

| K210365 | Pearl Inc. | Second Opinion | 2021 | 8 |

| K222746 | Overjet, Inc. | Caries Assist | 2022 | 6 |

| K210187 | Overjet, Inc. | Dental Assist | 2021 | 4 |

Pearl's K210365 stands as the most influential predicate in dental AI, cited by 8 subsequent devices from 6 different companies. When Pearl cleared "Second Opinion" in 2021, they didn't just enter the market—they created the regulatory template that competitors would follow for years.

Overjet's dual foundation (K210187 and K222746) demonstrates a deliberate strategy: by securing multiple early clearances across different indications, they established predicate pathways for both general dental analysis and specific caries detection applications.

The Middle Floors: Building on Proven Pathways

The middle tier of the regulatory structure shows how second-wave entrants leveraged the foundation:

| K Number | Company | Predicate(s) Cited | Year |

| K213795 | VideaHealth | K210365 (Pearl) | 2022 |

| K230144 | Denti.AI | K210365 (Pearl), K210187 (Overjet) | 2023 |

| K240003 | Velmeni | K222746 (Overjet) | 2024 |

These companies made a strategic choice: rather than establishing novel predicate pathways from external devices, they built directly on dental AI predecessors. This approach offers several advantages:

1.Faster review times — Similar predicates mean fewer questions from FDA reviewers

2.Clearer performance benchmarks — Acceptance criteria are already established

3.Reduced testing burden — Can reference predicate's clinical validation approach

4.Market validation — Building on a cleared device signals regulatory feasibility

The Top Floors: 2024-2025 Devices Still Under Construction

The newest entrants (2024-2025) represent the "top floors" of the regulatory structure—devices that benefit from multiple layers of established predicates below them. These devices often cite second-generation predicates, creating multi-generational chains:

Example Chain:

K210365 (Pearl, 2021)

└── K230144 (Denti.AI, 2023)

└── K250525 (Denti.AI, 2025)

This three-generation chain shows how regulatory infrastructure compounds: Pearl's 2021 clearance enabled Denti.AI's 2023 clearance, which in turn enabled their 2025 follow-on device.

Strategic Implications of the Predicate Network

For New Entrants: The window for becoming a foundational predicate is closing. With 15 dental AI devices already serving as predicates, the regulatory landscape is increasingly defined by existing players. New entrants face a choice: build on competitors' foundations (faster path to market, but you're implicitly validating their approach) or establish novel predicate pathways (slower and riskier, but creates differentiation and potential future leverage).

For Established Players: Your clearances are competitive assets beyond market access. Every time a competitor cites your device as a predicate, you gain insight into their development timeline, validation of your technical approach, and potential leverage in IP or partnership discussions.

For Investors and Acquirers: Predicate position is a moat indicator. Companies whose devices are frequently cited as predicates have proven regulatory pathways that reduce risk for follow-on products, established performance benchmarks that competitors must match or exceed, and strategic positioning that compounds over time.

The 26 External Predicates: Opportunities Remain

Despite the emergence of dental AI predicate hubs, 26 external (non-dental-AI) predicates remain in the network. These include general CADe devices from radiology, image processing systems from other medical specialties, and earlier dental imaging software (non-AI). For companies seeking differentiation, these external predicates represent potential pathways to establish new regulatory foundations rather than building on competitor devices.

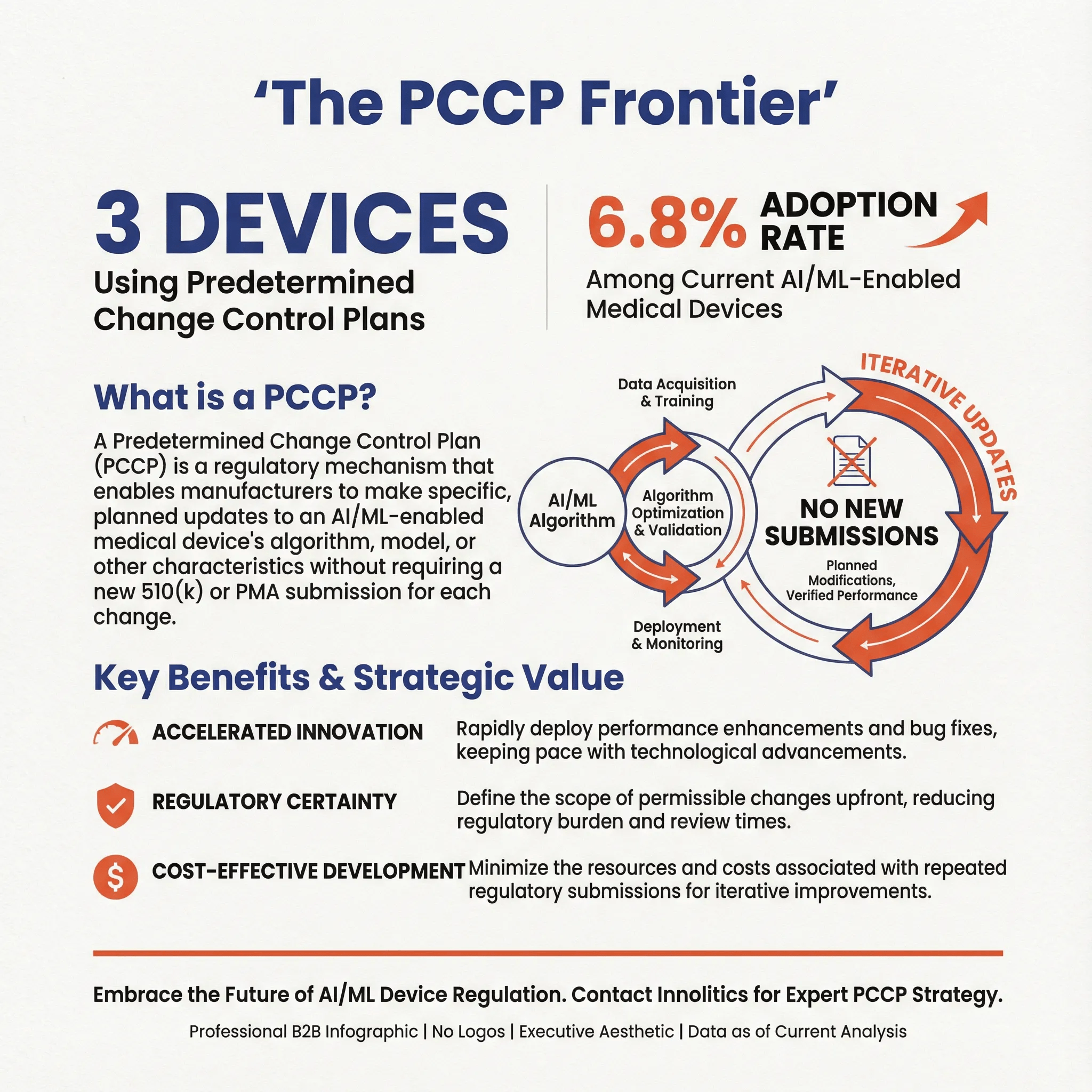

Part VII: The PCCP Frontier 🔗

Predetermined Change Control Plans in Dental AI

Only 3 devices (6.8%) have been cleared with a Predetermined Change Control Plan (PCCP), representing the cutting edge of adaptive AI regulation:

| Device | Company | Significance |

| Overjet Charting Assist | Overjet, Inc. | Workflow automation |

| VELMENI for DENTISTS (V4D) | Velmeni Inc. | Comprehensive platform |

| Axial3D Insight | Axial Medical Printing | 3D surgical planning |

A PCCP allows manufacturers to make certain pre-specified modifications to their AI/ML algorithms without requiring a new 510(k) submission. This is particularly valuable for AI systems that benefit from continuous learning and improvement.

Why PCCP Adoption Remains Low

The low PCCP adoption rate reflects several factors:

1.Regulatory complexity: PCCP submissions require detailed documentation of the modification protocol, performance testing methodology, and change boundaries.

2.First-generation focus: Many current devices are first-generation products focused on initial market entry rather than iterative improvement.

3.Learning curve: Both manufacturers and FDA reviewers are still developing expertise in PCCP evaluation for dental applications.

As the market matures, PCCP adoption is expected to increase significantly, enabling faster innovation cycles and continuous performance improvement.

The Dental AI Revolution — Part 3: Economics, Clinical Applications, and the Road Ahead 🔗

Part VIII: The Economics of Dental AI 🔗

Funding the Innovation 🔗

The leading dental AI companies have raised substantial capital:

| Company | Total Funding | Latest Round | Valuation |

|---|---|---|---|

| Overjet | $133 million | Series C (2024) | $550 million |

| Pearl | ~$80 million | Series B (2024) | ~$400 million |

| VideaHealth | ~$70 million | Series B (2025) | — |

Combined, the top three companies have raised over $280 million, reflecting significant investor confidence in the dental AI opportunity.

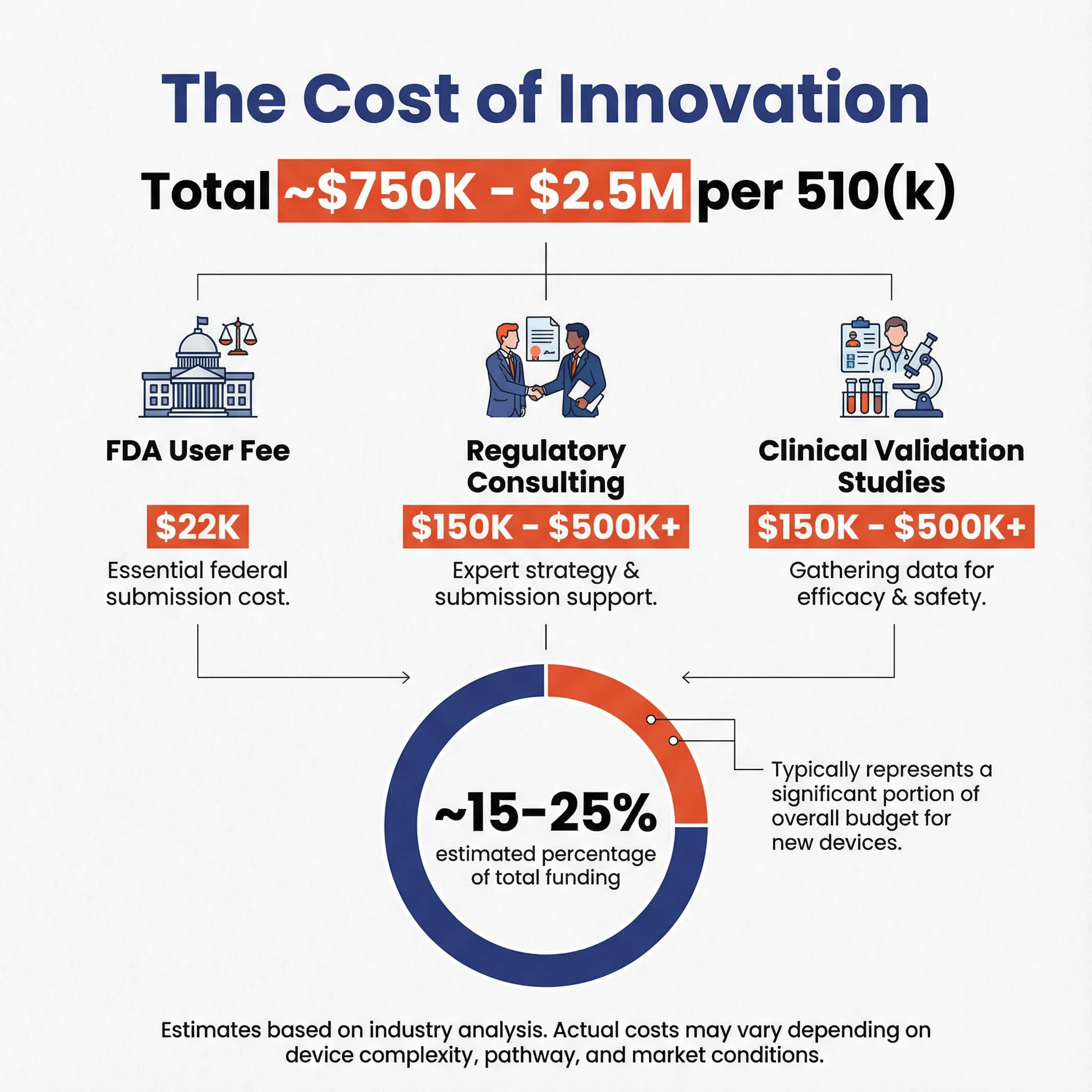

Estimating the Cost per 510(k) 🔗

A simple ratio of funding to clearances is misleading, as funding covers all company operations. A more realistic estimate assumes regulatory activities account for an estimated 15-25% of a company's budget—a higher proportion than general medical devices because dental AI requires substantial clinical validation studies to justify intended use claims.

Assumptions:

- Regulatory budget is ~15-25% of total funding, reflecting the significant investment in clinical studies.

- Costs include FDA user fees, regulatory consulting, and clinical validation studies (reader studies, sensitivity/specificity testing, multi-site data collection) required to substantiate performance claims.

- First clearance is the most expensive; subsequent ones leverage existing infrastructure.

Why 15-25%? Unlike simpler medical devices, AI/ML dental devices must demonstrate clinical performance through rigorous studies. These include reader studies comparing AI performance to ground truth established by expert panels, multi-site validation to prove generalizability across different patient populations and imaging equipment, sensitivity/specificity testing at the acceptance criteria thresholds (86-91% / 79-89%), and data collection and annotation for training and validation datasets.

Based on these assumptions, the estimated cost for a single dental AI 510(k) submission is likely in the range of $750,000 to $2,500,000.

Cost Breakdown 🔗

| Cost Category | Range | Notes |

|---|---|---|

| FDA User Fees | $6,500 - $26,000 | Small business vs. standard |

| Regulatory Consulting | $150,000 - $500,000+ | Strategy, submission support, and regulatory expertise |

| Clinical Validation Studies | $150,000 - $500,000+ | Reader studies, multi-site data |

| Data Collection & Annotation | $50,000 - $200,000 | Training and validation datasets |

| Software Development & Testing | Variable | Already part of R&D |

| Quality Management System | $25,000 - $75,000 | Documentation and compliance |

Note: Cost estimates based on industry analysis. Actual costs vary significantly based on device complexity, intended use scope, and company infrastructure.

The clinical validation component represents the largest variable cost, with complexity scaling based on the breadth of intended use claims and the number of target conditions.

Part IX: Clinical Applications and Use Cases 🔗

The Diagnostic Focus 🔗

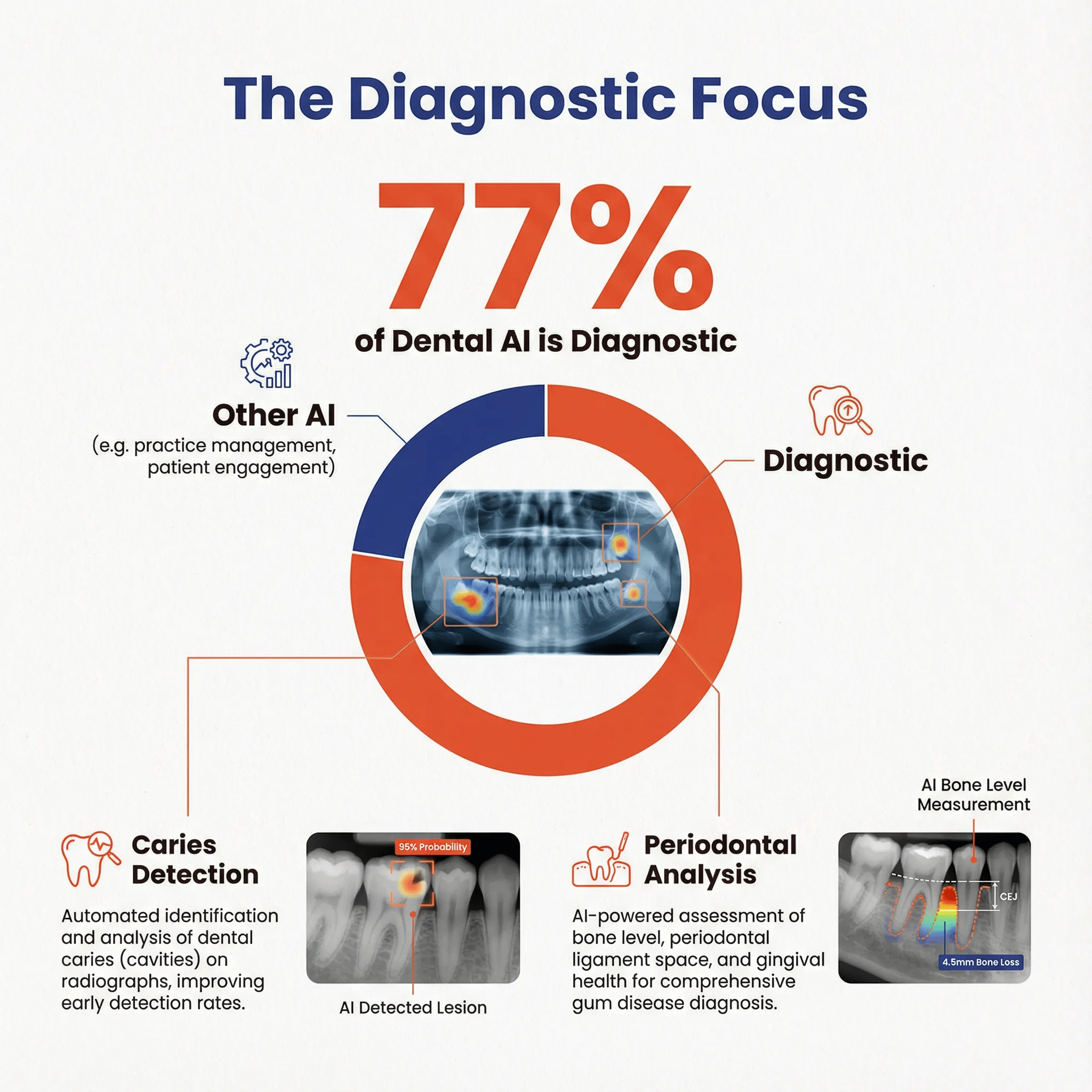

77.3% of cleared devices are classified as diagnostic, reflecting the market's emphasis on detection and analysis rather than treatment planning or therapeutic applications.

This diagnostic focus makes strategic sense:

- Clear clinical need: Missed caries and early pathology represent significant clinical and liability concerns

- Well-defined task: Detection tasks have clear success metrics (sensitivity, specificity)

- Regulatory pathway: Diagnostic devices have established predicate history

- Integration simplicity: Detection overlays integrate easily into existing workflows

Image Type Coverage 🔗

| Image Type | Frequency | Clinical Context |

|---|---|---|

| Periapical | 61.4% | Single-tooth detail |

| Bitewing | 54.5% | Interproximal caries |

| Panoramic | 25.0% | Full-arch overview |

| Intraoral | 18.2% | General category |

The emphasis on periapical and bitewing radiographs reflects the core use case: detecting interproximal caries and periapical pathology on the most commonly acquired dental images.

Part X: The Road Ahead 🔗

2026 Predictions 🔗

Based on the exponential growth trajectory, we project continued acceleration in 2026:

| Scenario | Predicted Clearances | Methodology |

|---|---|---|

| Conservative | 19 | Linear extrapolation |

| Moderate | 28 | Exponential trend |

| Aggressive | 36 | Accelerated adoption |

The moderate estimate of 28 clearances represents a 55% year-over-year growth rate, which would push the cumulative total to approximately 72 devices by the end of 2026.

Case Study: Smile Dx: From Concept to FDA Clearance 🔗

We are proud of one of our clients for making it on the list of the 18 dental AI devices cleared this year.

The Challenge 🔗

Dentists often miss subtle caries (cavities) and periapical radiolucencies on standard X-rays. Cube Click wanted to solve this with AI but needed a partner who could handle both the complex deep learning engineering and the rigorous FDA regulatory process. As a bootstrapped startup, they couldn't afford missteps or delays.

The Solution 🔗

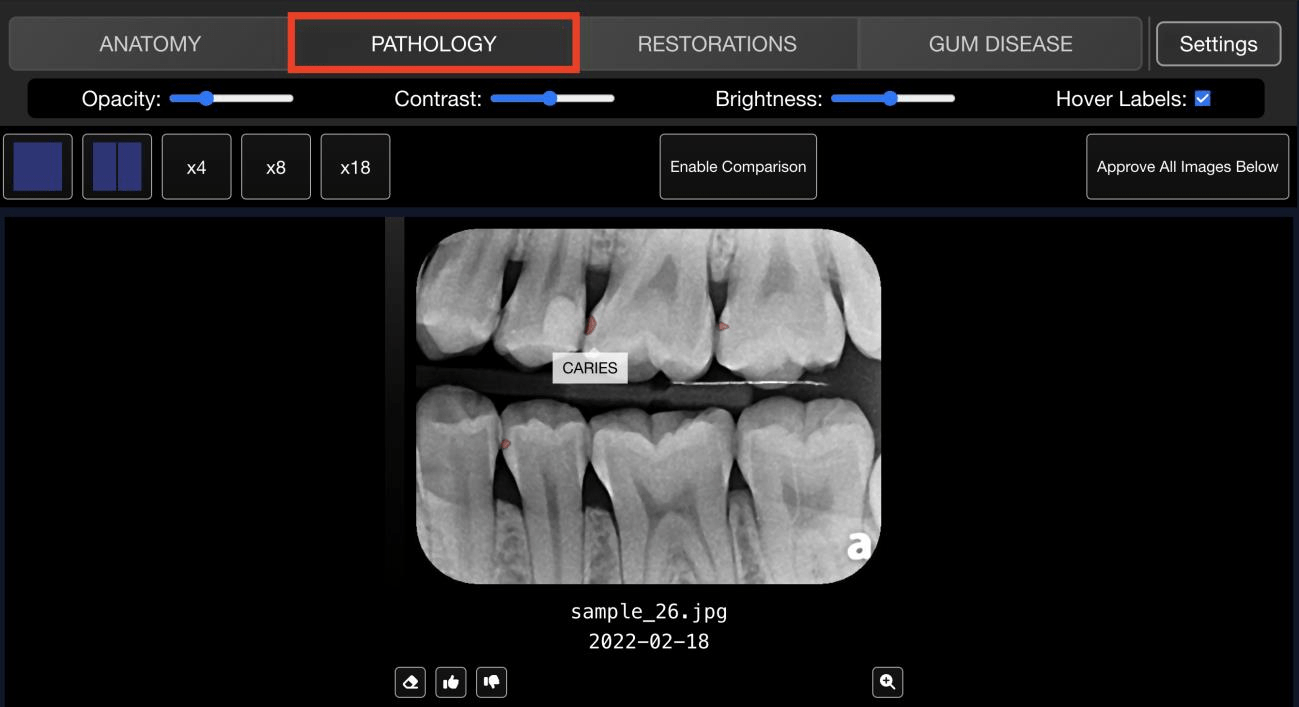

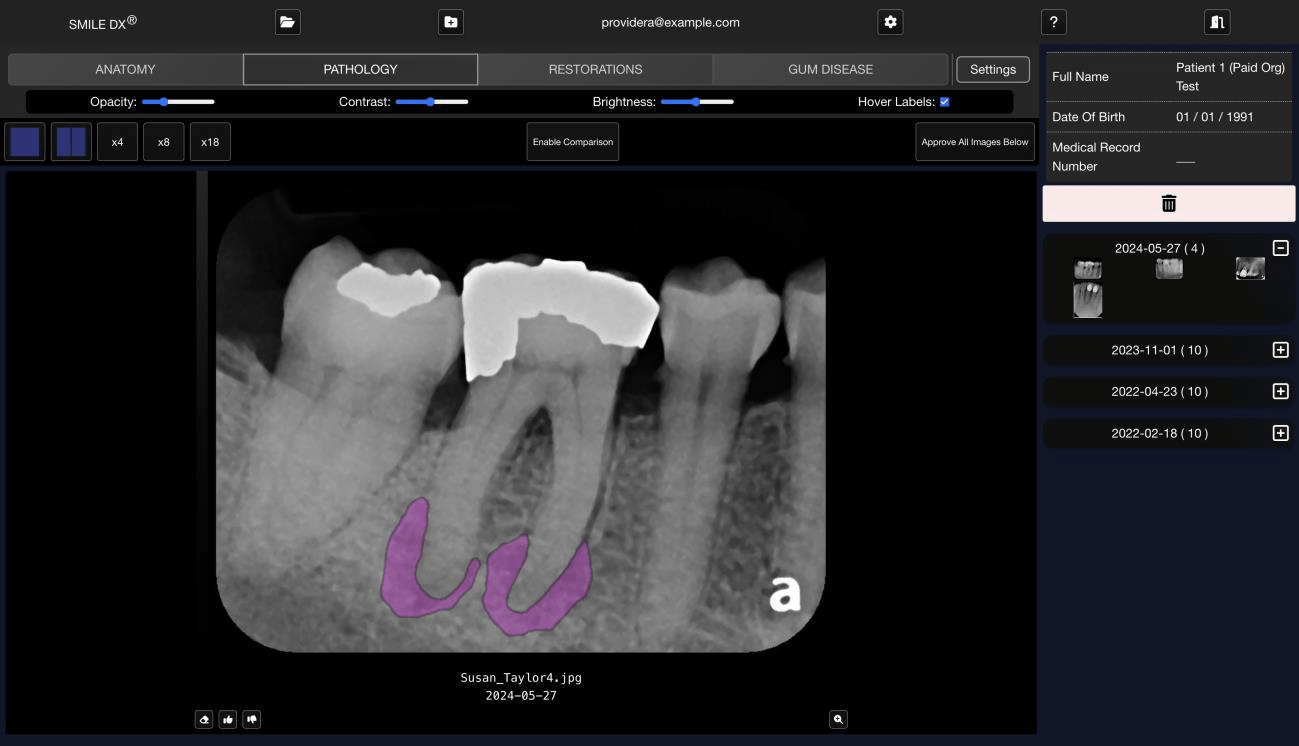

Innolitics served as Cube Click's full-stack engineering and regulatory team. We:

- Engineered the AI: trained deep-learning models for automatic segmentation and detection of dental anatomy and pathology.

- Built the Platform: Developed a secure cloud-based web application with a built in image viewer.

- Navigated the FDA: Managed the entire regulatory lifecycle, from Pre-Submission to a successful 510(k) clearance.

- Managed the FDA Study: Managed the entire FDA validation study from ground truthing, multi-reader-multi-case study, standalone performance, and biostats analysis.

The Result 🔗

Smile Dx received FDA 510(k) clearance in June 2025!

Frequently Asked Questions 🔗

Conclusion: Don't Get Left Behind 🔗

The dental AI market has reached a turning point. With 44 devices cleared, 15 serving as predicates for others, and 28 companies competing for market share, the regulatory landscape isn't a blank slate anymore. Early movers have set the foundation.

You need a partner with experience in the Dental AI space and with deep engineering and regulatory experience to get you FDA cleared with speed and certainty.

Don't let regulatory hurdles stall your innovation. Let's get you FDA cleared in 2026.

Already on the market? Protect your market share by speeding up your regulatory clearance process.

Innolitics guarantees 510(k) clearance if:

- Your algorithm passes our suggested acceptance criteria as we determine during our regulatory strategy and presub service

- And getting FDA clearance is one of the top priorities of your organization

Innolitics guarantees 510(k) submission timeline if:

- Your algorithm is complete and can be containerized or be packaged as an SDK

- And you allow us to project manage the submission and allow us to communicate directly with your engineers

- And getting FDA clearance is one of the top priorities of your organization