First, credit where credit is due. Despite challenging times, government shutdowns, and questionable public opinion, the FDA still managed to clear a record-breaking number of medical devices for the US public—in a way that maximizes both innovation and public safety. We're also deeply appreciative of the countless free services, such as presubmissions and breakthrough device designations, that have made a tangible impact on the medical device landscape in the US.

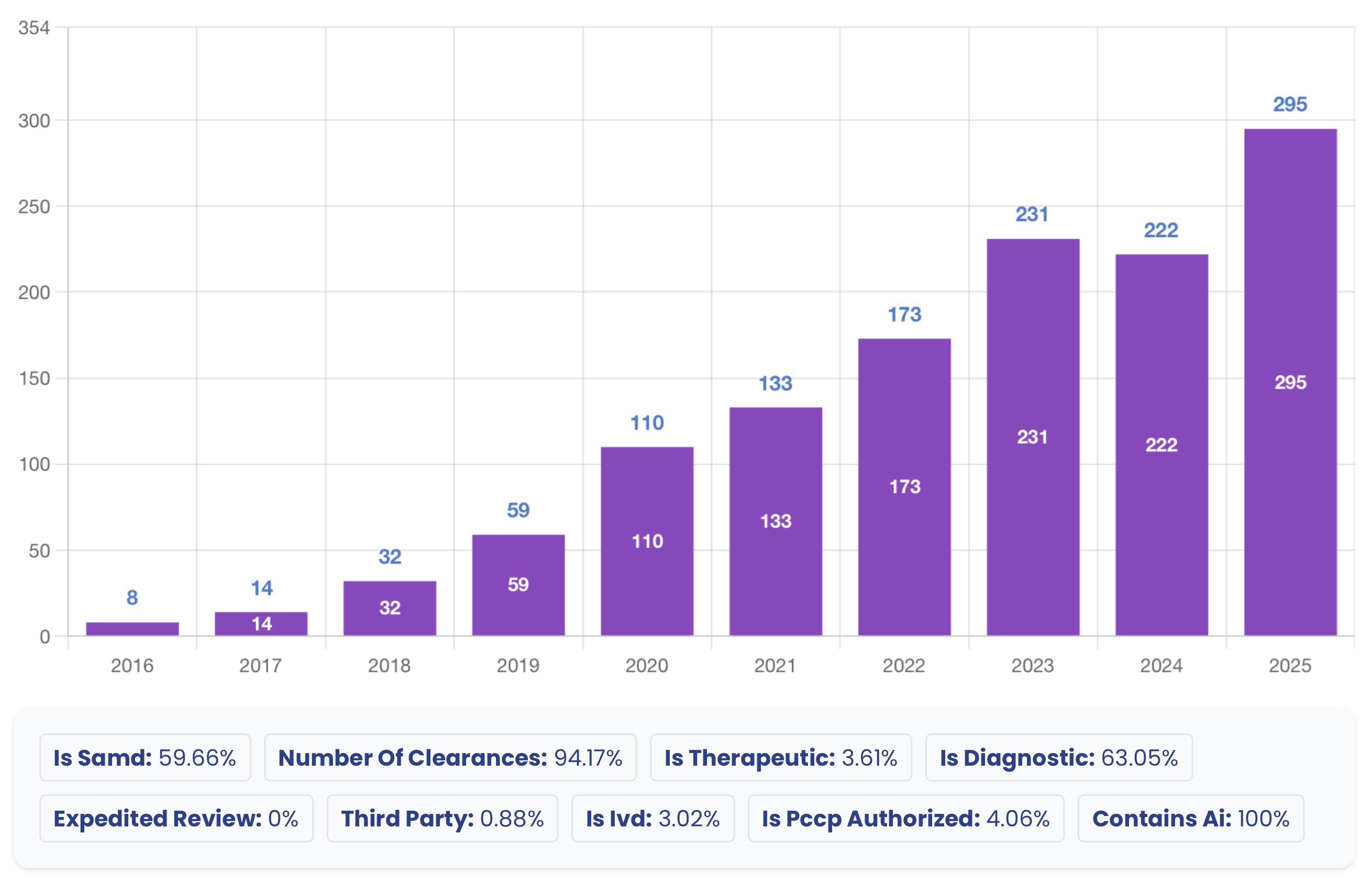

At Innolitics, staying current with industry trends and regulatory developments is how we ensure we deliver on our FDA clearance and submission timeline guarantees. 2025 marked a breakthrough year for AI/ML medical devices, with 295 FDA clearances spanning diagnostic tools to therapeutic software. This surge—from both industry leaders and startups—demonstrates AI's central role in modern healthcare. The data is clear: intelligent medicine is here, reshaping patient care with unprecedented speed and scale.

Please note, we used AI to identify these devices. While we spot checked everything, we may have missed some devices. However, we feel the executive level directional insights are still valid even though some of the numbers may be a little off.

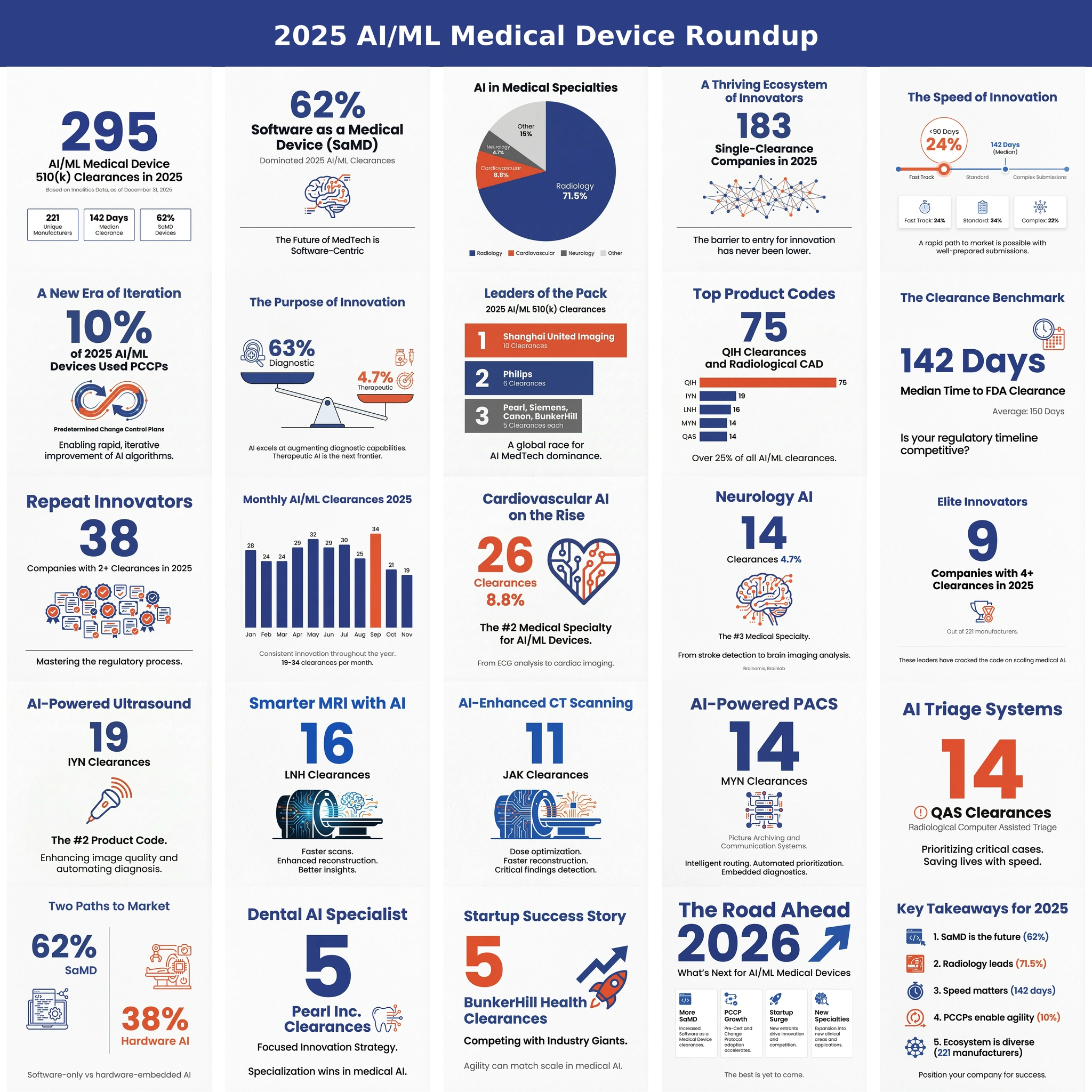

2025 AI/ML Medical Device 510(k) Clearances: Executive Summary

Key Metrics

- 295 total clearances from 221 unique manufacturers

- Median clearance time: 142 days

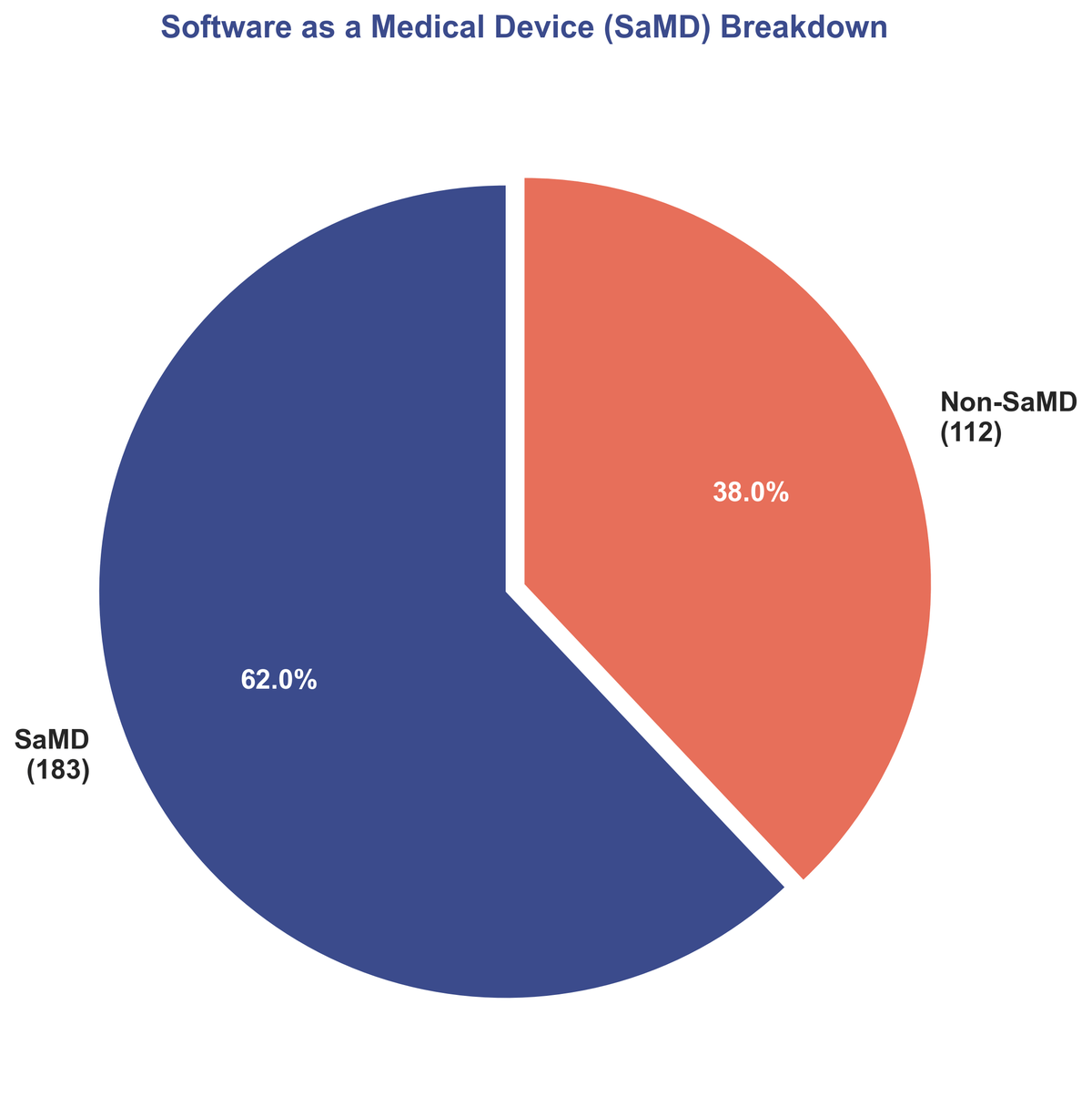

- 62% were SaMD devices; 63% diagnostic

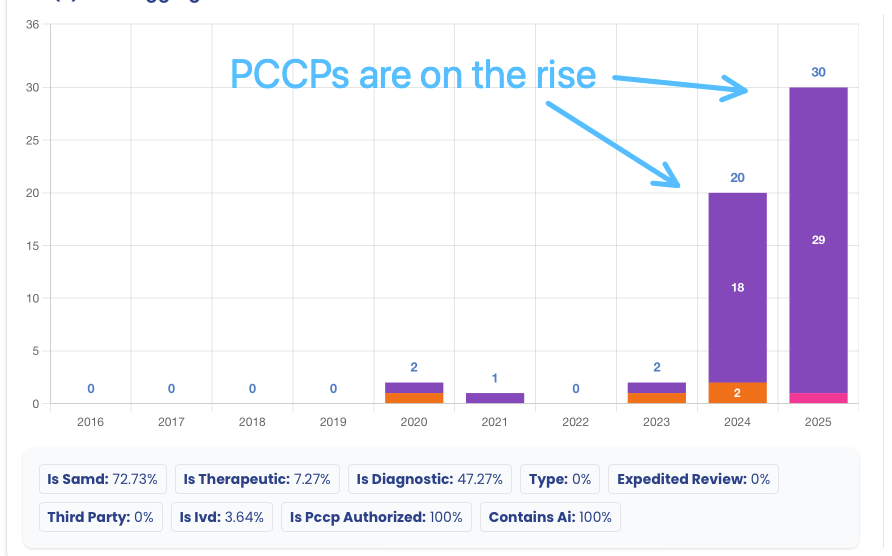

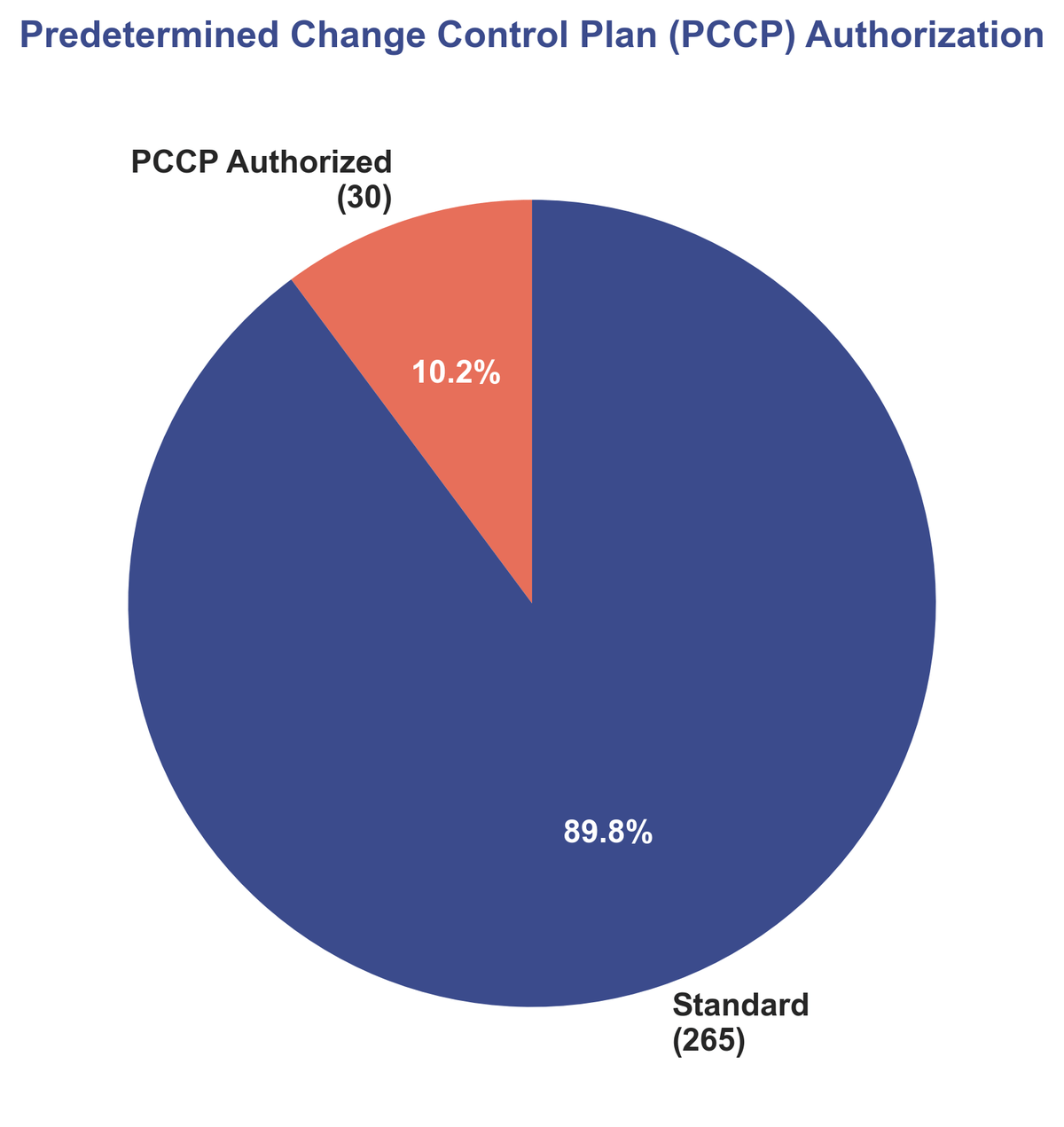

- 10% authorized with PCCPs for iterative updates

Market Leaders

- Shanghai United Imaging Healthcare led with 10 clearances

- 183 manufacturers had single clearances, indicating a thriving startup ecosystem

- Only 9 companies achieved 4+ clearances

Clinical Focus

- Radiology dominated at 71.5% of all clearances

- Cardiovascular (8.8%) and Neurology (4.7%) were distant seconds

- Top product code: QIH (Radiological CAD) with 75 clearances

Review Timelines

- 24% cleared in under 90 days

- 22% took over 200 days for complex submissions

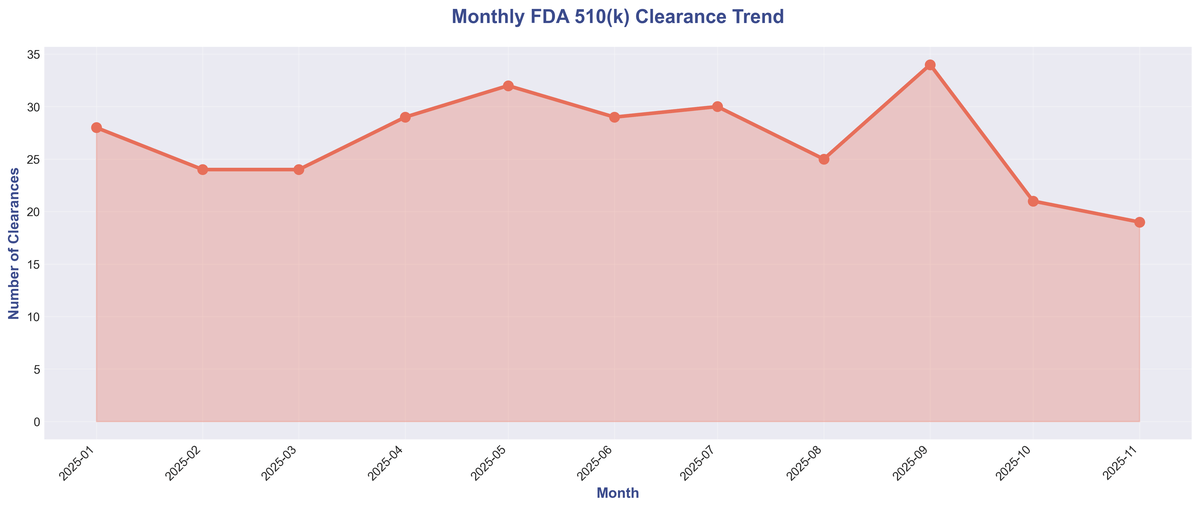

- Consistent monthly pace: 19-34 clearances per month

The Big Picture: 2025 by the Numbers 🔗

In 2025, the FDA granted clearance to 295 AI/ML-enabled medical devices, a testament to the industry's incredible momentum. This analysis covers a full year of innovation, highlighting key trends that are defining the future of MedTech.

| Metric | Value |

|---|---|

| Total Clearances | 295 |

| Unique Manufacturers | 221 |

| Average Days to Clearance | 150 |

| Median Days to Clearance | 142 |

| SaMD Devices | 183 (62%) |

| Diagnostic Devices | 187 (63%) |

| PCCP Authorized | 30 (10%) |

The Unstoppable Rise of Software as a Medical Device (SaMD) 🔗

One of the most dominant trends of the year is the continued rise of Software as a Medical Device (SaMD). 62% of all AI/ML clearances fell into this category. SaMD, which is software intended for medical purposes without being part of a hardware medical device, represents a fundamental shift in how medical technology is developed and deployed. This software-centric approach allows for rapid iteration, scalable distribution, and seamless integration into clinical workflows, accelerating the delivery of advanced capabilities to the point of care.

The implications of this shift are profound. Unlike traditional hardware devices that require physical manufacturing and distribution, SaMD can be deployed globally with a simple software update. This enables manufacturers to reach more patients faster and to continuously improve their products based on real-world performance data.

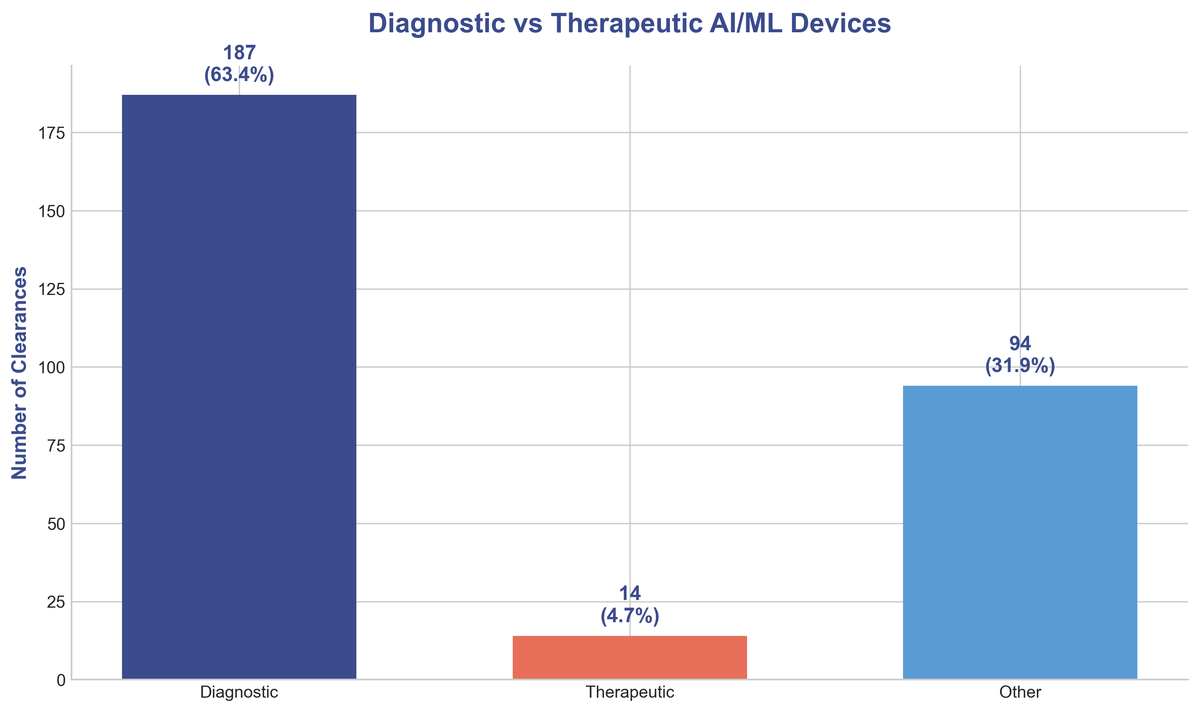

The Purpose of Innovation: Diagnostic vs. Therapeutic 🔗

While AI's potential is vast, its application in 2025 was heavily focused on diagnostic purposes. Over 63% of cleared devices were designed to aid in the detection and diagnosis of diseases. This highlights the immense value of AI in augmenting the capabilities of clinicians, helping them to identify patterns and make more informed decisions from complex data.

In contrast, therapeutic applications, while growing, represent a smaller but significant portion of the landscape at 4.7%. This points to future growth in AI-driven treatment and intervention, an area ripe for innovation as the technology matures and regulatory pathways become clearer.

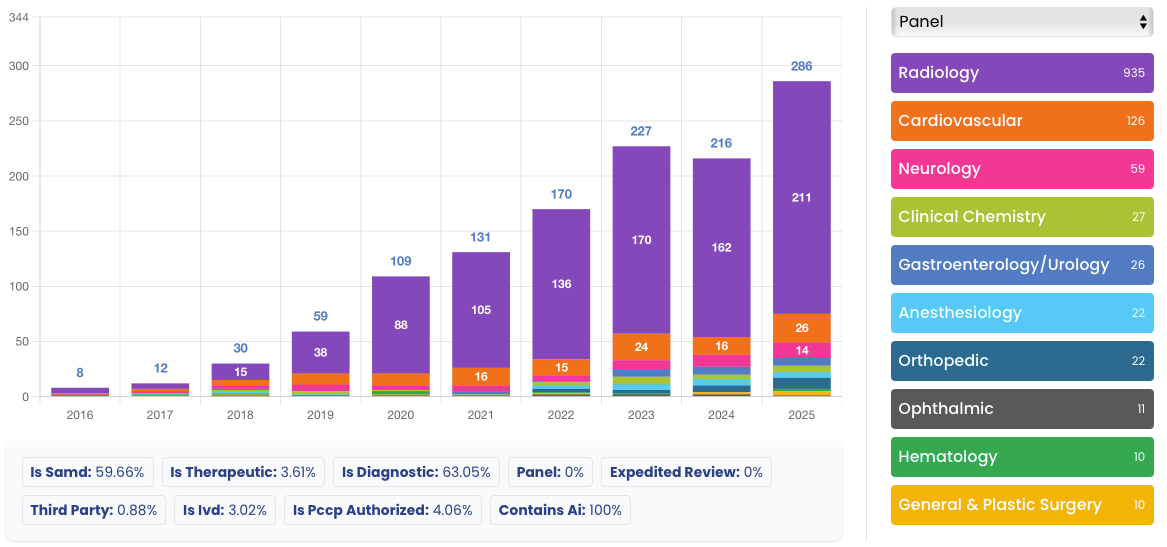

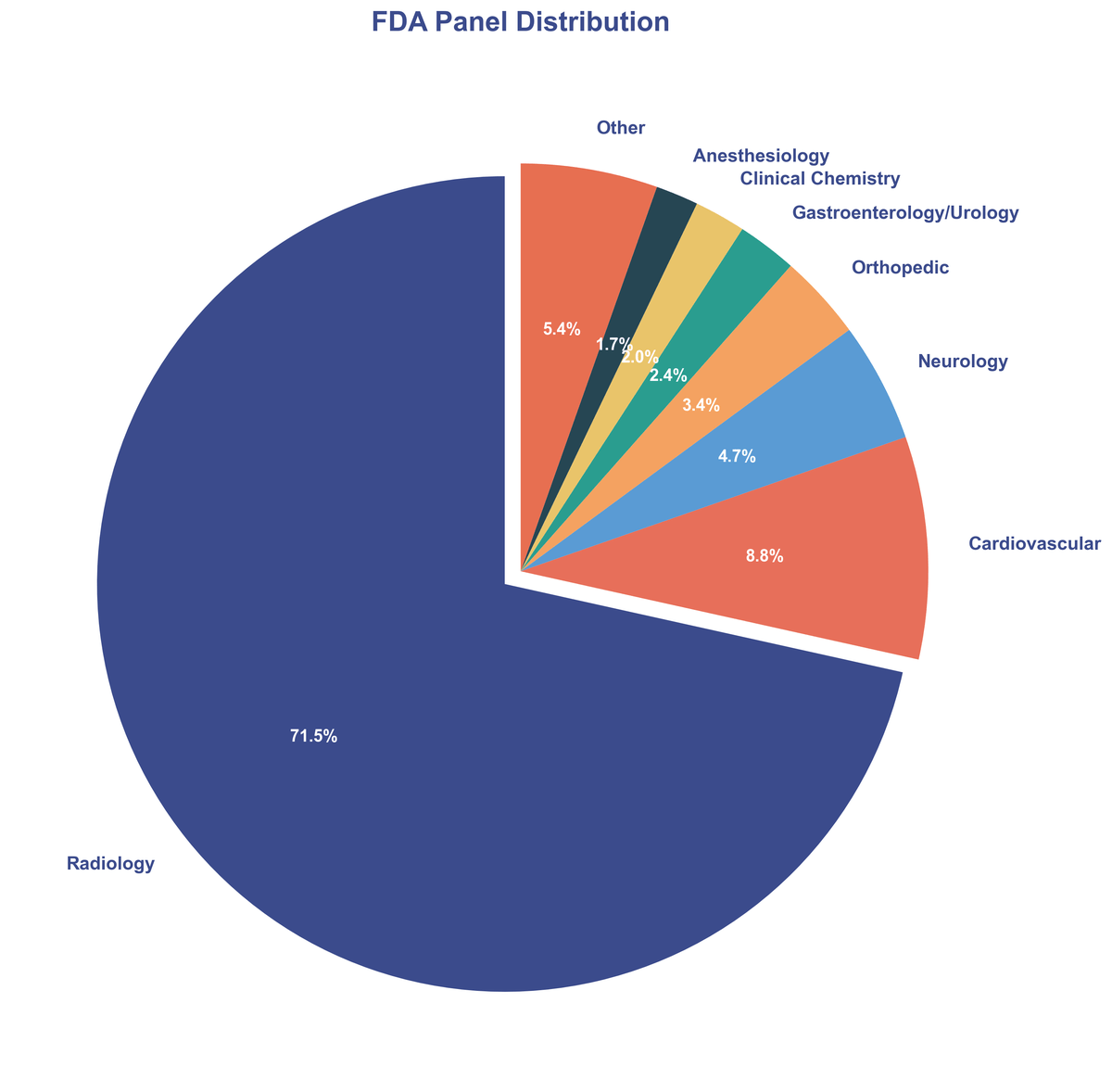

Focus Areas: A Deep Dive into Medical Specialties 🔗

While AI is making inroads across all fields of medicine, Radiology continues to be the undisputed leader, accounting for a staggering 71.5% of all AI/ML device clearances. This underscores the immense value of AI in medical imaging analysis, from improving diagnostic accuracy to streamlining workflows. The visual nature of radiology data makes it particularly well-suited for AI analysis, and the field has been at the forefront of AI adoption for years.

| Medical Panel | Clearances | Percentage |

|---|---|---|

| Radiology | 211 | 71.5% |

| Cardiovascular | 26 | 8.8% |

| Neurology | 14 | 4.7% |

| Orthopedic | 10 | 3.4% |

| Gastroenterology/Urology | 7 | 2.4% |

| Clinical Chemistry | 6 | 2.0% |

| Anesthesiology | 5 | 1.7% |

| Other | 16 | 5.5% |

Cardiovascular and Neurology also emerged as significant areas of innovation, demonstrating the expanding reach of AI into complex disease areas. These specialties deal with intricate physiological data and often require rapid, accurate interpretation—areas where AI excels.

The Innovator Landscape: A Mix of Titans and Trailblazers 🔗

The AI/ML medical device space is a dynamic battlefield, with established industry giants and agile newcomers all vying for a foothold. In 2025, we saw a healthy mix of both, indicating a vibrant and competitive ecosystem.

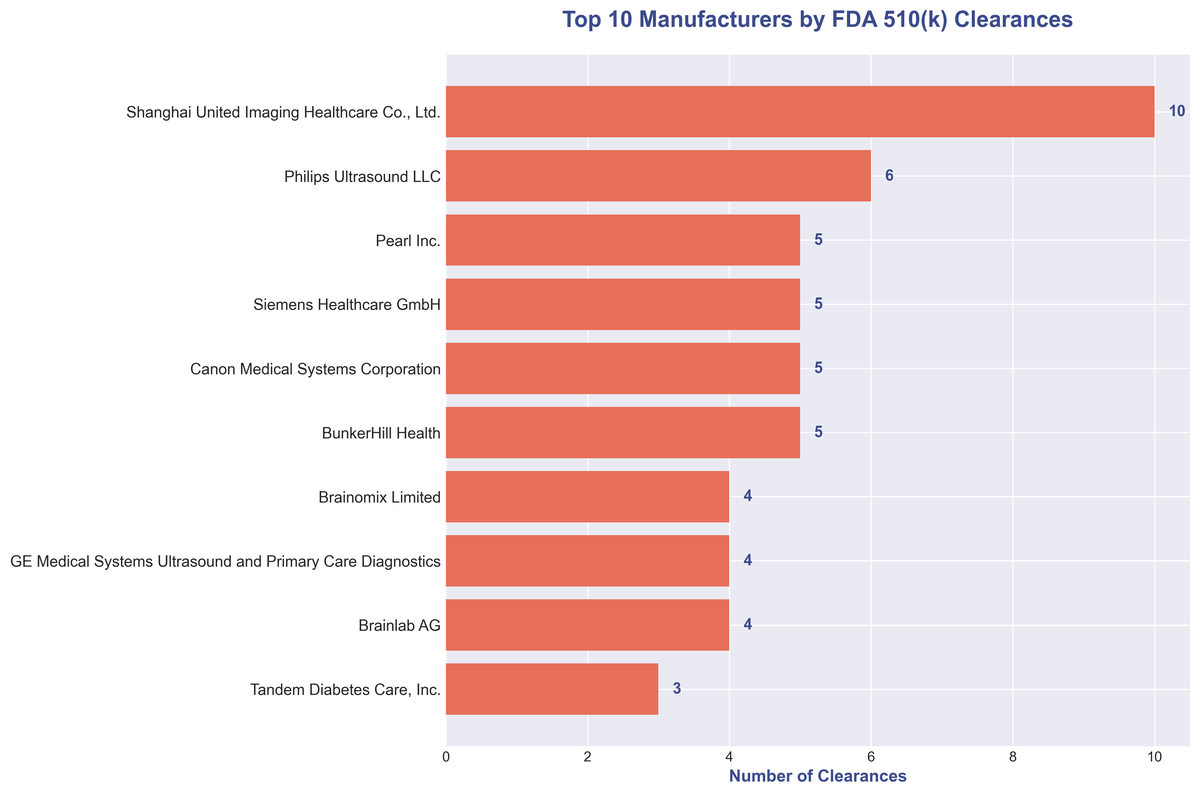

The Leaders of the Pack 🔗

The top of the leaderboard is occupied by a mix of international powerhouses, with Shanghai United Imaging Healthcare leading the charge with an impressive 10 clearances. They are closely followed by a cohort of well-known names in the medical imaging and device space.

| Rank | Manufacturer | Clearances |

|---|---|---|

| 1 | Shanghai United Imaging Healthcare Co., Ltd. | 10 |

| 2 | Philips Ultrasound LLC | 6 |

| 3 | Pearl Inc. | 5 |

| 4 | Siemens Healthcare GmbH | 5 |

| 5 | Canon Medical Systems Corporation | 5 |

| 6 | BunkerHill Health | 5 |

| 7 | Brainomix Limited | 4 |

| 8 | GE Medical Systems Ultrasound and Primary Care Diagnostics | 4 |

| 9 | Brainlab AG | 4 |

| 10 | Tandem Diabetes Care, Inc. | 3 |

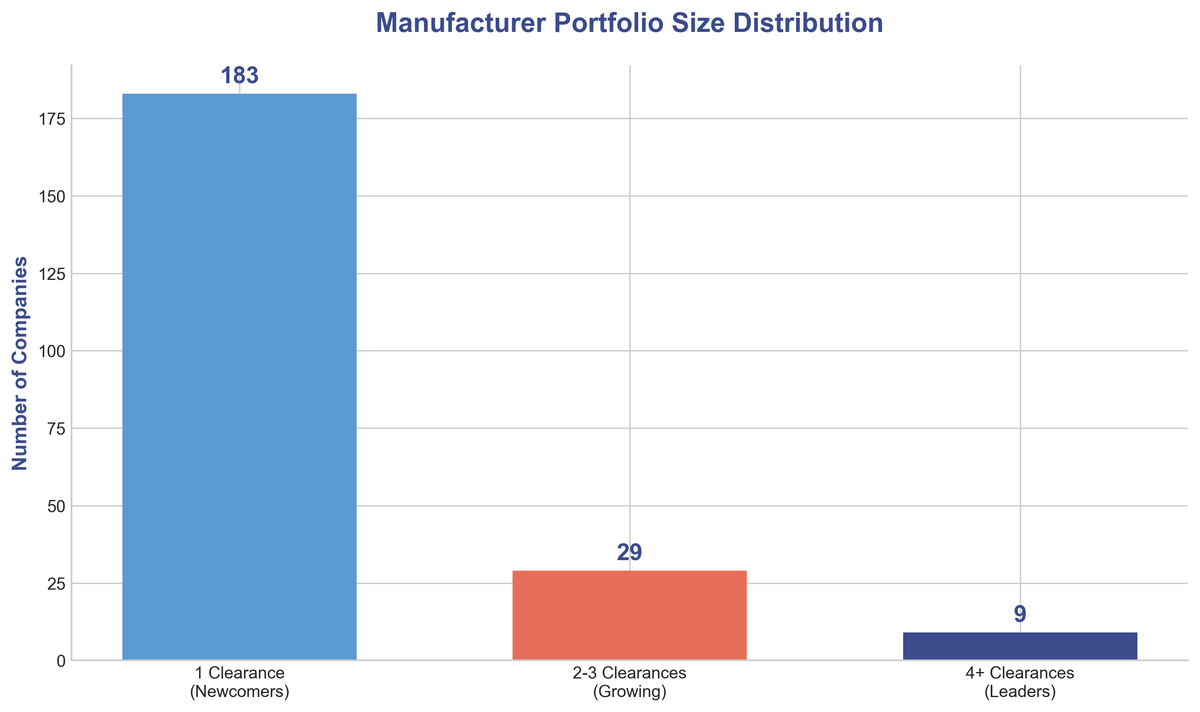

A Thriving Ecosystem of Innovators 🔗

Beyond the top players, the data reveals a remarkably diverse landscape. A total of 221 unique manufacturers received at least one clearance in 2025. Most impressively, 183 of these were companies with a single clearance, suggesting a thriving startup scene and a low barrier to entry for innovative ideas. This influx of new players is a critical engine for progress, pushing the boundaries of what's possible and challenging the status quo.

Only 9 companies achieved 4 or more clearances, establishing themselves as the true leaders in the space. These companies have demonstrated the ability to consistently bring innovative products to market and navigate the regulatory landscape efficiently.

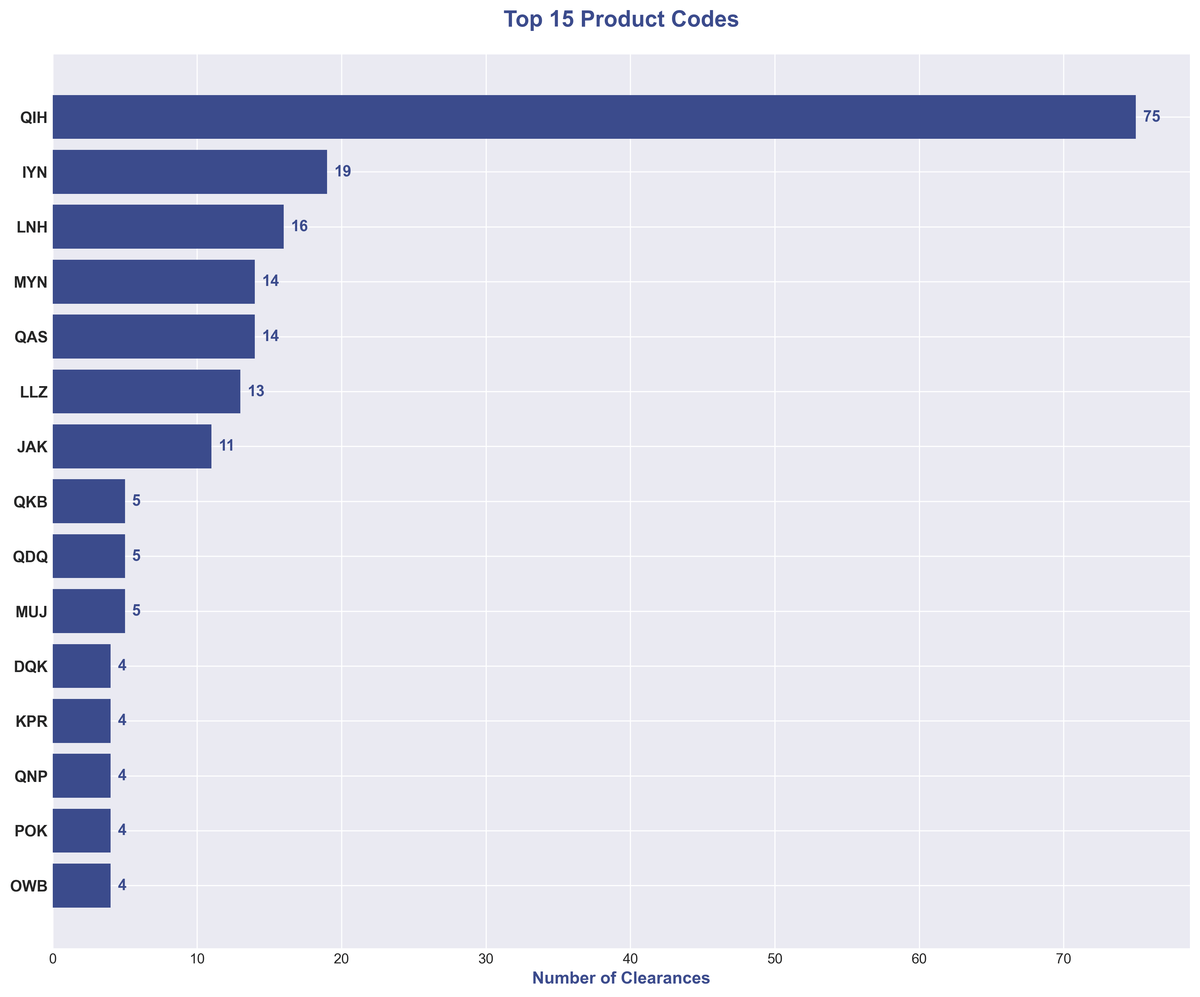

Under the Hood: Top Product Codes 🔗

A closer look at the product codes reveals the specific types of devices driving this trend. The most frequent product codes point to a heavy concentration in radiological image processing and analysis software.

| Product Code | Clearances | Description |

|---|---|---|

| QIH | 75 | Radiological Computer Assisted Detection/Diagnosis |

| IYN | 19 | Ultrasound System |

| LNH | 16 | MRI System |

| MYN | 14 | Picture Archiving and Communication System |

| QAS | 14 | Radiological Computer Assisted Triage |

| LLZ | 13 | MR Applications Software |

| JAK | 11 | CT Scanner |

The dominance of QIH (Radiological Computer Assisted Detection/Diagnosis) with 75 clearances—representing over 25% of all clearances—underscores the central role of AI in helping radiologists detect and diagnose conditions from medical images.

The Regulatory Horizon: Navigating the Path to Market 🔗

Understanding the regulatory landscape is crucial for any innovator. The data from 2025 provides valuable insights into the FDA's 510(k) pathway for AI/ML devices.

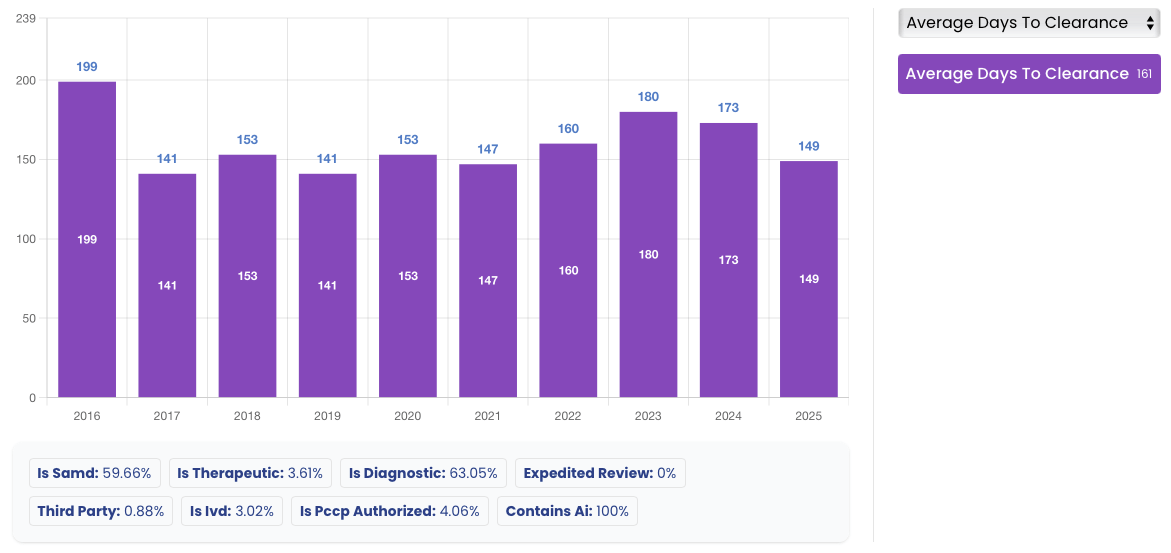

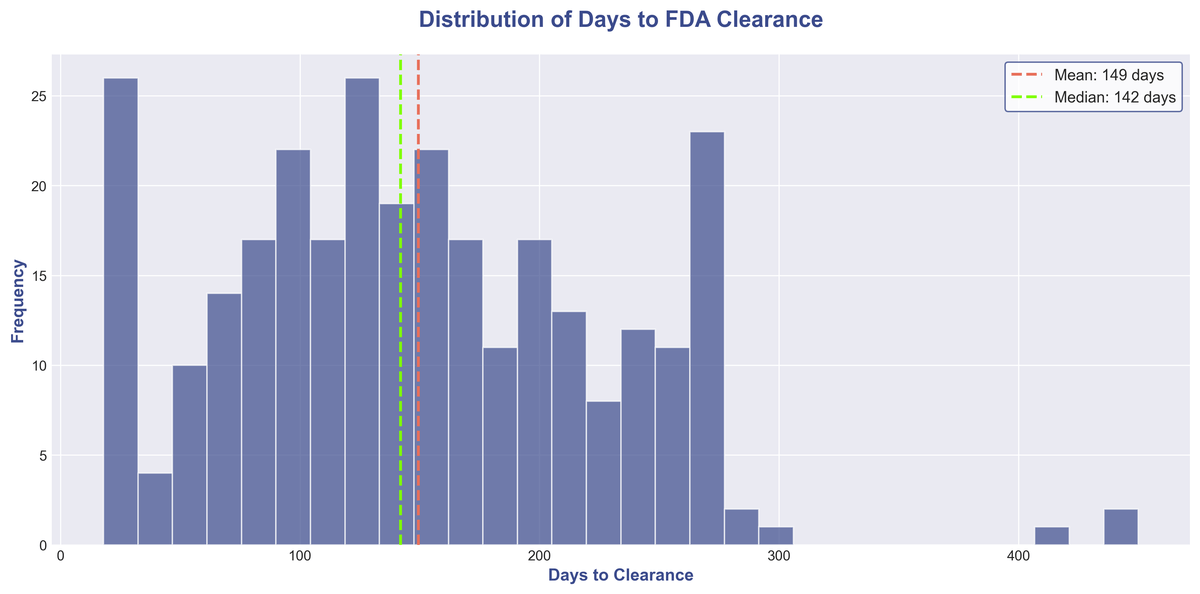

The Speed of Innovation: How Long Does Clearance Take? 🔗

The journey from submission to clearance is a key consideration. In 2025, the median time to clearance was 142 days, with an average of 150 days. However, there is significant variability:

| Timeline Category | Days | Count | Percentage |

|---|---|---|---|

| Fast Track | <90 | 71 | 24.1% |

| Standard | 90-150 | ~100 | ~34% |

| Extended | 150-200 | ~60 | ~20% |

| Complex | >200 | ~64 | ~22% |

A quarter of all devices were cleared in under 90 days, demonstrating the potential for a rapid path to market for well-prepared submissions. On the other end of the spectrum, some devices took over 200 days, highlighting the complexities and challenges that can arise with more novel or complex technologies.

A New Era of Iteration: The Rise of PCCPs 🔗

One of the most exciting regulatory developments is the adoption of Predetermined Change Control Plans (PCCPs). In 2025, 30 devices (10.2%) were cleared with a PCCP. This innovative framework allows manufacturers to pre-specify and get authorization for future modifications to their AI/ML models without needing a new submission for every change.

This is a game-changer for the industry, enabling rapid, iterative improvement of algorithms and ensuring that patients and clinicians have access to the most up-to-date technology. As AI models continuously learn and improve, the PCCP pathway provides a regulatory framework that keeps pace with the technology.

Monthly Clearance Trend: Consistent Innovation Throughout the Year 🔗

The flow of clearances remained remarkably consistent throughout the year, with monthly totals ranging from 19 to 34. This steady pace indicates a robust pipeline of innovation and a well-functioning regulatory process.

| Month | Clearances |

|---|---|

| January 2025 | 28 |

| February 2025 | 24 |

| March 2025 | 24 |

| April 2025 | 29 |

| May 2025 | 32 |

| June 2025 | 29 |

| July 2025 | 30 |

| August 2025 | 25 |

| September 2025 | 34 |

| October 2025 | 21 |

| November 2025 | 19 |

Continued Excellence: Recognizing Repeat Innovators 🔗

While the influx of new players is exciting, it's also important to recognize the established leaders who consistently drive innovation. In 2024, 38 manufacturers achieved two or more FDA 510(k) clearances for their AI/ML devices, demonstrating a sustained commitment to advancing the field. These companies are the backbone of the industry, and their continued excellence sets the standard for others to follow.

Here are the 38 companies that received two or more clearances in 2024, recognized for their sustained commitment to innovation:

| Clearances | Manufacturer |

| 10 | Shanghai United Imaging Healthcare Co., Ltd. |

| 6 | Philips Ultrasound LLC |

| 5 | Pearl Inc. |

| 5 | Siemens Healthcare GmbH |

| 5 | Canon Medical Systems Corporation |

| 5 | BunkerHill Health |

| 4 | Brainomix Limited |

| 4 | GE Medical Systems Ultrasound and Primary Care Diagnostics |

| 4 | Brainlab AG |

| 3 | Tandem Diabetes Care, Inc. |

| 3 | Siemens Medical Solutions USA, Inc. |

| 3 | Aidoc Medical, Ltd. |

| 3 | GE Medical Systems, LLC |

| 3 | GE Medical Systems SCS |

| 3 | BrightHeart |

| 2 | iSchemaView, Inc. |

| 2 | Magentiq Eye LTD |

| 2 | Artrya Limited |

| 2 | Huxley Medical |

| 2 | GE Medical Systems Ultrasound and Primary care Diagnostics, |

| 2 | Galileo CDS, Inc |

| 2 | EOS imaging |

| 2 | Avatar Medical |

| 2 | Circle Cardiovascular Imaging Inc. |

| 2 | Moon Surgical |

| 2 | Peek Health, S.A. |

| 2 | Methinks Software S.L. |

| 2 | Therapixel |

| 2 | TeraRecon, Inc. |

| 2 | Samsung Medison Co., Ltd. |

| 2 | Gleamer SAS |

| 2 | JLK, Inc. |

| 2 | DiA Imaging Analysis Ltd. |

| 2 | AZmed |

| 2 | Clarius Mobile Health Corp. |

| 2 | FUJIFILM Corporation |

| 2 | Shanghai United Imaging Healthcare Co.,Ltd. |

Congratulations to all the companies recognized for their continued excellence and their invaluable contributions to the future of healthcare!

Looking Ahead: The Dawn of an Intelligent Era in Healthcare 🔗

The trends from 2025 paint a compelling picture of an industry in the midst of a profound transformation. The rapid adoption of AI and SaMD, coupled with a more agile regulatory framework through PCCPs, is not just a fleeting trend; it's a fundamental shift in how we approach healthcare.

Key Takeaways for Industry Leaders 🔗

- SaMD is the future: With 62% of clearances being software-based, the industry is moving toward software-centric solutions.

- Radiology leads, but opportunities abound: While radiology dominates, emerging areas like cardiovascular and neurology present significant growth opportunities.

- Speed matters: Companies that can navigate the regulatory process efficiently (median 142 days) gain a significant competitive advantage.

- PCCPs enable agility: Early adopters of PCCP frameworks are positioning themselves for continuous improvement and faster iteration cycles.

- The ecosystem is diverse: With 221 unique manufacturers, there's room for both established players and innovative newcomers.

As we look to the future, we can expect to see even more sophisticated, personalized, and predictive solutions that will empower clinicians and improve the lives of patients around the world. The innovation engine is firing on all cylinders, and the best is yet to come.

However, realizing this potential requires more than just breakthrough technology—it demands a predictable path to market.

Don’t get left behind in 2026! 🔗

Regulatory hurdles shouldn't stall your innovation. Let’s get you FDA cleared in 2026. More and more competitors are arriving on the scene and we don’t want you to be left behind.

Already on the market? You need to protect your market share by accelerating your regulatory clearance process and culture. Hire us for one of our done-for-you services so we can teach your team how it is done.

Innolitics guarantees 510(k) clearance if:

- Your algorithm passes our suggested acceptance criteria as we determine during our regulatory strategy and presub service

- And getting FDA clearance is one of the top priorities of your organization

Innolitics guarantees 510(k) submission timeline if :

- Your algorithm is complete and can be containerized or be packaged as an SDK

- And you allow us to project manage the submission and allow us to communicate directly with your engineers

- And getting FDA clearance is one of the top priorities of your organization